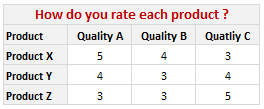

Often when we make a survey to compare various products (or vendors, companies, brands) the results are in the following format:

Now, we can visualize such data in several ways. One of the obvious ways to visualize is to make a stacked bar chart. But it results in poor representation of values as we cannot easily compare ratings of one vendor to another. This is where a panel chart would help. A sample panel chart for above data can be like this:

A panel chart (often called as trellis display or small-multiples) shows data for multiple variables in an easy to digest format. It lets users compare in any way and draw conclusions with ease.

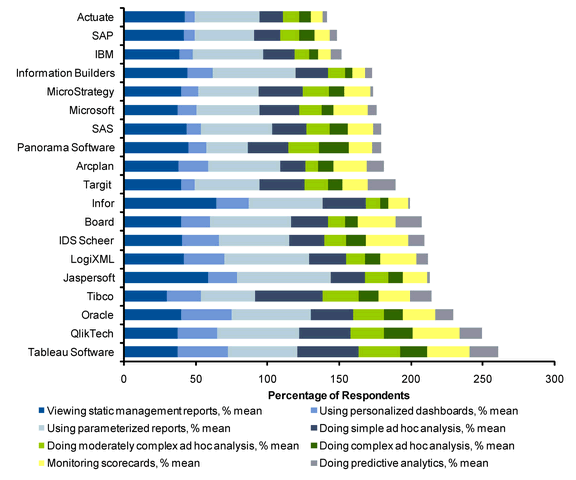

Today, I want to discuss how the principles of panel chart can be applied to visualize a complex set of survey results. For this we will use the recent survey conducted by Gartner on how various customers use BI (Business Intelligence) tools. The folks at Tableau have done good analysis of this data and presented the results in this format:

While the above chart is ok, it doesn’t let you compare vendors very well. We can only compare them on first usage, “viewing static management reports”. For everything else, the base line changes, so it is difficult to draw meaningful conclusions if, for example, you want to know which software is getting used more for “doing complex adhoc analysis”.

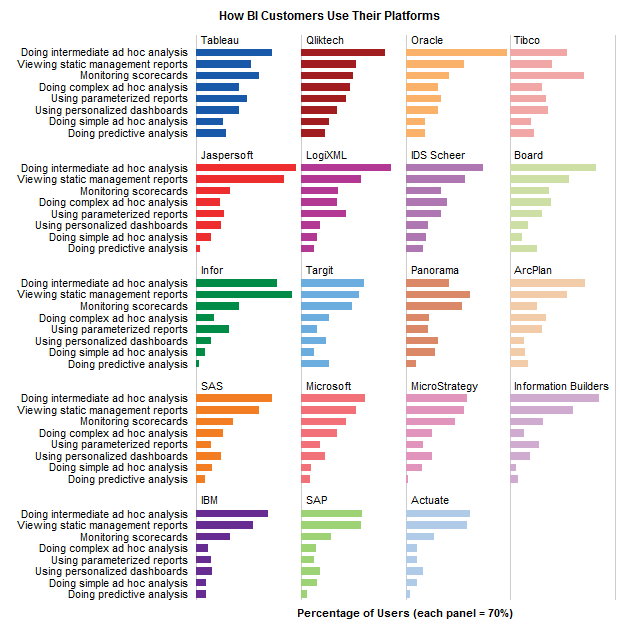

Jon Peltier has done beautiful analysis of this chart and presented various alternatives in his post yesterday. One of his recommendations is, of course, making a panel chart like this:

While, Jon’s Panel Chart greatly improves the readability of these survey results, I have 2 problems with it.

- Making such a panel chart in Excel is like baking your own bread. If you are like me, after few hours, you would run to bakery both hungry and frustrated. Panel Charts are not native in Excel. That means, we have to bribe, coax, threaten, protest and bend over backwards to prepare something like this in Excel. Thankfully people have already done that. So we can follow the examples and learn from their lead. [here is a panel chart tutorial from Jon]. However, the point still remains that, creating a panel chart in excel is a pain.

- Once such a panel chart is constructed, it is still pretty rigid. For eg. if you are interested in knowing how IBM as a BI vendor fares, you would like to have the results sorted by IBM’s BI Usages, but doing that in this carefully weaved panel set up means going to square 1 with less dough. So, we are stuck with a panel chart where the values cannot be sorted by any one vendor.

Is there a simpler way to construct panel charts in Excel?

So, I wondered, “is there a better and simpler way to make this chart that would still let me compare values (by BI vendor or BI Usage), let me sort and still save me enough time to drive down to one of the best bakeries in town to get a nice fluffy donut?“.

Of course there is…

The trick is to use Incell Charts. Ahem!

Instead of carefully tweaking chart options, adding dummy series and hiding them in the charts, we can just use incell charts with REPT formula and then align them in the cells. Since Excel naturally has the grid layout, creating panels (or small multiples) is as easy as snapping your fingers. (pls. note, this method of panel chart is only applicable for bar / column charts. If you need panels of line charts or scatter charts, you still need to use the methods suggested by Jon.)

We can also easily add a sorting option and use the lovely LARGE formula to sort the results based on selected vendor.

Here is what I prepared using the above recipe and it took me less than 20 minutes to set this up.

[click here for larger version of this]

How is the above incell panel chart constructed?

I am sure you are eager to know how this chart is constructed. Here is the secret:

- I took the raw data from Jon’s site and then Pivoted it so that we get the survey results in a table (with vendors on top and usages on left).

- I have dedicated a cell to let user select the sort order. Let us call this cell as “K3”

- Based on the vendor selected in K3, I have sorted the entire raw data using LARGE formula (and generous use of MATCH, INDEX, OFFSET formulas as well – examples here and here).

- Then I used the REPT formula to plot the incell bar charts (and the font “play bill” so that the bars look thick and nice).

- I have topped this with conditional formatting so that sorted vendor can be highlighted in different color.

Download the Incell Panel Chart Workbook

Download the Incell Panel chart workbook to play with it. I am sure you will find something useful and fun in that. [mirror download link]

How would you chart survey results?

There are still few problems with this approach though (for eg. adding labels can be a pain), but all in all, this simplifies the charting task and leaves room for adding extra features like sorting, conditional formatting.

Here is a open invitation. We have a long weekend coming up, thanks to Easter. So go ahead and download the original data here. And make your own charts for this survey data. The objective is that we should be able to compare vendors with each other with ease. Save your charts as images and upload them somewhere. Then leave a comment here with that URL so that we all can know how you would chart survey results.

Also, share your opinion on this type of panel charts. What is your experience with them? Do you like / hate panel charts?

66 Responses to “Budget vs. Actual Charts – 14 Charting Ideas You can Use”

[...] Update: Check out the results at Budget vs. Actual Charts [...]

Hi there:

I'm interested in understanding exactly how contestants #'s 1, 8 got their surplus or shortfall to show up at the top of the bar (is this overlapped or stacked somehow) and change colour? I hope this makes sense. I've tried to find samples and I can see contestant 8 (cuboo) may have used something called graphomate but I can't use this.

I need to create a bar chart that shows budget, and actual variance whether it be a surplus or a shortfall and I would like make it look like option 1 or 8 above but haven't a clear idea how to do it...any help would be greatly appreciated!

Regards..Linwe

[...] heute können alle Beiträge auf “Pointy Haired Dilbert” gesichtet und bis zum 12.04. bewertet werden. Falls mein Vorschlag - Nr. 8 - gefällt, freue ich [...]

Danken Sie Excel friend!

#6 is the best here. Simple, no extraneous visual effects.

I was all set to vote for #9...until I noticed its lack of y-axis labels. So I have to go with #6 also.

I think #6,#9 is enough .

#9 is my favorite

Nice data/ink ratio 😉

I agree with Jon - #6 for me.

8 & 14

I go for # 9 (simple) and #14 (complete)

I go for cuboo #8

cheers

#6 for overview at a glance / top management

#8 for deeper analysis / those who need more detailed information

#14 although I think you only need the bottom panel and I then would stack the Center charts vertically to make Center comparisons easier.

#10 gets my vote.

If there is a second place, then #14

denise

Hi, if I was not wrong, Samples 3,4 and 5 were created using Tableau software and not Excel. For more information on Tableau you might want to visit http://www.tableausoftware.com/. It was initially designed by Prof. Pat Hanrahan and his PhD students. I am not their salesperson but I thought someone might want to know more about this particular technology.

Hi Tin Seong Kam:

Thanks - I have looked at Tableau before. I have also found the means to reproduce something similar to chart 8 without using graphomate, and also chart 7. I proposed chart 9 as well but the overlap is confusing to some.

I am really not too concerned about showing actual budget figures but the variance in $ and % is important for my particular use. That is why I gravitate to the charts that seem to easily tell us that we have a surplus or a shortfall.

Thanks!

Linwe

11, 6, 9 (presque pareil)

7 pour la clarté

cuboo #8 ist my favorite

best regards...

8

8 is fantastic

I prefer N#8 - N# 1,7 & 8 use the settings of Rolf Hichert...

6 : The GURU (read "Jon Peltier ") has spoken,

SOO easy on eyes!

Hi Chandoo,

I liked Cuboo's submission. So #8 gets my vote.

Regards,

Sumit

Number 8 by far. Even though it's not part of the data display, the comments feature sells me. Variance explanations are as important as the actual variances.

I visually prefer #8, but #3 is really easier to understand, even if it lacks a lot of information (inverting budget/actual), legend, etc...

[...] All in all there are several great entries suggesting a good variety to present budget vs. actual performance. Go check them out. [...]

[...] reshape, zoo by learnr A reader of a Pointy Haired Dilbert blog enquired about best ways to visualise budget vs. actual performance. In response PHD challenged his blog readers to contribute their visualisations made using Excel or [...]

anyone willing to post their xls for these? Some really excellent exmaples.

To avoid the summary execution of the person presenting these to an executive team these charts must handle overspending as well as underspending, be comprehensible in 5 seconds and show the key fact clearly. The key fact isn't budget or actual - it's the magnitude of the gap!

Therefore:

#14 for nailing the key fact and being able to handle overspending. The winner therefore.

#6 for nailing speed-reading and being able to handle overspending, but somewhat obscuring the key fact. Second place.

#8 for nailing information depth and aesthetics. Third place.

I really wanted #8 to win, but that's the technician's view not the end-user's.

[...] Todas as contribuições podem ser vistas no seguinte endereço: Budget vs. Actual Charts – 14 Options You can Use Posted on April 5th, 2009 http://chandoo.org/wp/2009/04/05/budget-vs-actual-charts/ [...]

Social comments and analytics for this post...

This post was mentioned on Twitter by NancyJHess: I like to explore fav tweets of those I follow. Here is one from DutchDriver http://twurl.nl/17eiap Creative visual charts: Budget vs Actual...

number 8

clean, full of info, qualitative as well as quantitative

Hi,

I Like 4 chart in above as per the following ratings:-

no 1# -> 14***

no 2# -> 7***

no 3 # -> 8**

no 4# -> 1.3**

I will be greateful if someone can send me the process of making all above 4 charts.

Virender

[...] Budget vs. Actual Values in Charts – 14 more options [...]

[...] Budget vs. Actual – 14 charting options [...]

Does anyone know what type of chart #6 is (chart name?)? Also, how do I create this is Excel 2007?

@Shazbot

I'd call it a Column and Bar chart, but don't get hungup on names

To make it try this:

Setup the chart as a Clustered Column Chart

Change the Series so there is 100% overlap, ie: One column is in front of the other

Change the Budget series to a line chart

Set the line color to none

Set the marker style to a Flat Line

Change the marker width to make it the same width as the bar

Change colors and other chart properties to suit

Does anyone have an idea on how to create chart #1?

Thanks

Caroline, please see the german page: http://www.hichert.com/de/software/exceldiagramme/55

there you can find the original example for nr1.

best regards,

stefan

Caroline

This is a Clustered Stacked Column Chart

Which has the column under the Shortfall/Excess colored the same as the Budget

Have a look here

http://chandoo.org/forums/topic/question-about-budget-v-actual

&

http://peltiertech.com/WordPress/clustered-stacked-column-charts/

Hi,

Is it possible to get the source files like the other visualisation challenge (on sales).

Thanks,

Vijay

Dear Chandoo,

I discovered your site by pure chance and I am really thrilled about it and I am learning a lot.

Is it possible to post the source file for this visualisation challenge?

Thanks,

Vijay

[...] Budget vs. Actual Charts in Excel [...]

Dear Chandoo,

How do I create Chart #10 (comparing Budget vs Actual Performaces) by cost center by quarter without the cumulative performance. Do you have an actual example that I could use?

Thanks,

Greg

HI

Does anyone can help me to a to create chart #7? I'm beginer in excel , I started to work two weeks ago and my boss ask me to follow the budget/actual until the end of the year.

SO I really need your help.

Thanks in advance

p.s Sorry for my english ( i'm french)

@OKI, Greg

I have made a mockup of #7 and #10

It is available at:

http://chandoo.org/wp/wp-content/uploads/2009/04/Bud-Act-visualizaion-challenge-7+10..xlsx

#10 is a straight, Pivot Chart/Table but the data has been rearranged to get it into the pivot table

#7 is 2 charts, being a simple Bar Chart and a Scatter Chart with 100% Error Bars

I have used Named Formulas for the two charts.

HELLO Hui

Thanks you very much for your hepl , i really appreciate

Have I nice week

Hi,

I was wondering how can you replicated chart 1.3? The bars looked like there overlapped on two different axis?

Tony

I think 1 & 3 are good.

Hi Chandoo,

Please can you provide a link of the excel sheet for 1. Chart "3 colors and everything is clear"

I would like to drill into the spreadsheet and learn the secrets as how the chart was made.

Many thanks,

Sawan

@Sawan

It is probably 12 seperate charts, I will assume snapped to the underlying cells to ensure they are the same size

The left 3 Charts have a vertical Axis

The bottom 4 Charts have a horizontal Axis

The remainder have no axis

The remaining text maynot be part of the charts but is probably cell content

Saludos,

Como puedo descargar estos maravillosos ejemplos para estudiarlos y analizarlos deseo aprender a realizar este tipo de graficas en Excel.

Gracias,

Dear Chandoo and Hui,

Please would you help me (step by step if possible) to create Chart #8?

Many thanks in advance!

Dear Chandoo,

I think chart #8 is really great. Would really appreciate if you can show basic step to create it.

Thanks 🙂

Hi all,

Is there any step by step tutorial to recreate the the chart #1 please?

Would really appreciate if someone could show me how it done.

Regards

Sawan

Can someone tell me how do you create chart number 2? Thanks!

Am I the only one that can not display any of the images? Would love to take a look at these. This is the ONLY page on the whole website I have had this issue with. 🙁

Dear All,

how can i create chart # 7? is there any link where i can subscribe to your website by paying a certain amount. i want to learn some good excel techniques.

please let me know.

Cant see the images 🙁

Where can I find the link to download some of the above charts?? these are extremely usefull chart and would like to utilize the same.

Waiting for the reply.

Thanks..

I am interested for # 1,6,7,8,9,10,11 its very exciting for me .

Hi,

Just wanted to check, is there any possibility that pivot table or drop down work in power point?

Regards

Satyapal

@Satyapal... you can only use static images or slide animations in Power Point. Not features like pivot tables or drop downs. However, you can embed the entire workbook (or sheet) in a presentation. When clicked this will just open Excel so your users can play with the data.

Is there any instalment kind of facility available for joining the online course of Rs.12000/-.

Regards

Ramesh N

Hi,

I badly want to replicate #10. Can someone help me.. I've checked google to help but I can't figure out how to add the total 🙁

Regards,

Tim