All articles with 'Financial Modeling School' Tag

Creating Cash Flow Statement by Indirect Method – II

So what’s the cash with Facebook? Last time, we announced the launch of a new module on getting the cash flow statement in our financial modelling course and also discussed the procedure to create the cash flow statement. I had shared with you the template for financial statements for Facebook. I had asked you to implement the steps and create the cash flow model for Facebook!

We know that the devil is in the details. Last time we discussed the process and in this post, we would implement the cash flow statement for Facebook using the indirect method.

Continue »Have you created models which run into 20 – 30 years? You might have noticed that navigating to the last year (the last column) is probably the most boring part (and also the most time consuming part). Excel does provide you a shortcut (Ctrl + end), but that hardly works! It’s been a while since […]

Continue »Offset() function to Calculate IRR for Dynamic Range

Offset() function to Calculate IRR for Dynamic Range When you start the project can you be sure, for how long will you operate it? A VC gives you funds to buy a commercial project. You are to operate the project for some time and then sell it off! Can you tell me today, when you […]

Continue »

On a cup of green tea with a friend I grabbed the golden rule of accounting. It is simple (You can easily miss if it came your way!) and can be applied to almost all the accounts (Depreciation, Gross Block, Cash, Equity, Debt) – You name it, and you have to use it! So concentrate […]

Continue »Financial Modeling School is Open, Please Join Today!

Hello friends & readers of Chandoo.org,

I am very excited to tell you that our financial modeling & project finance classes are open for registration starting today.

In this article, you can learn about our training program, how it can help you & payment instructions.

Continue »Sumproduct function to Consolidate Revenues?

Chandoo.org is all about simplifying life using Excel. When I first started visiting the site, I was amazed at the amount of information on the site, which made your life easier. My next few posts would be about excel functions which can make your life for Financial Modeling easier! These are simple examples that you […]

Continue »Mod() function in excel to Implement Escalation Frequency [Financial Modeling Tutorials]

![Mod() function in excel to Implement Escalation Frequency [Financial Modeling Tutorials]](https://chandoo.org/wp/wp-content/uploads/2011/04/EscalationFrequency.gif)

You take an apartment on rent at $1000 per month and the owner puts an escalation clause saying 10% increment each 3 years. How do you model this in excel? In this tutorial we understand how escalations at certain frequency can be implemented using the mod function in excel. What is the mod() function Simply […]

Continue »Financial Modeling School is closing in a Few Hours – Join Now!

I have a quick announcement for you.

As you may know, we have re-opened registrations for our 2nd batch of Financial Modeling School on Feb 23rd. We will be closing the doors for new students tonight at 11:59 pacific time. Thank you so much for supporting this program enthusiastically.

As you may know, we have re-opened registrations for our 2nd batch of Financial Modeling School on Feb 23rd. We will be closing the doors for new students tonight at 11:59 pacific time. Thank you so much for supporting this program enthusiastically.

If you wish to join Financial Modeling School, click here.

Continue »

Many of us want to learn advanced Excel and make progress in our career. But how to do it? In this post, I show 3+1 ways in which you can learn advanced excel.

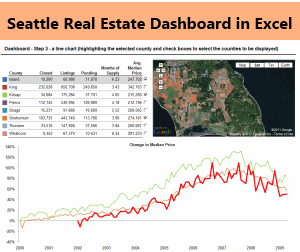

Last week I did an interview with Robert Mundigl of clearlyandsimply.com. Robert is an Excel wizard. You may know him thru the KPI Dashboard articles he has written on chandoo.org a while ago.

We spent about 90 minutes discussing some really cool & advanced Excel stuff. The interview will be available shortly on Excel School for our Dashboard students. But here is a snapshot of the dashboard we discussed in the interview. Robert taught me how to make such a dashboard using Excel.

Continue »Financial Modeling School is Open, Please Join Today

Hi my friends & readers of chandoo.org,

I have an exciting news for you. We have just opened the doors for our financial modeling course.

Please click here to learn more about the program & join.

What is Financial Modeling School?

This is an online training program for financial modeling, project finance modeling. I have partnered with Pristine Education, a company in India that specializes in Financial Modeling training to conduct this program.

This program is aimed at investment bankers, financial analysts, commercial bankers, equity research associates, project managers, sponsors, real estate project managers etc. to help them understand the nuances of project finance, financial modeling and create complex financial models using MS Excel.

Read rest of this post to learn more about the program.

Continue »Details about upcoming Financial Modeling School

We are opening Financial Modeling School for 2nd batch of classes on 23rd February. It feels very exciting to re-run this successful program. I want to share a few details about the program so that those of you interested to join can know more about it.

Please read this short post to learn 10 things about the financial modeling school program.

Continue »Financial Modeling School Closing in a Few Hours – Join Now!

I have a quick announcement for you.

As you may know, I am running an Online Financial Modeling Training Program called as Financial Modeling School in collaboration with Pristine Education. We have opened registrations for first batch of this program on October 18th. Thank you very much for supporting this program wildly. In a few hours, I will be closing the registrations for Financial Modeling School.

Click here to sign up for Financial Modeling School

Continue »FREE Excel Financial Model for Analyzing an IPO – Download Today

Lets keep this quick and short, As some of you may know, There is a mega IPO (initial public offering) going on in India these days. It is for a company called Coal India Ltd. So my partners at Pristine Education thought, it would be cool to build a financial model analyzing the IPO. Click […]

Continue »Financial Modeling School is now Open – Register today!

Hi all,

A very quick announcement. We have opened Financial Modeling School for registrations now. Click here to learn more about the program and sign-up.

You get $100 discount if you are one of the first 100 students to sign-up. So go ahead and enroll today.

Continue »Financial Modeling School Coming on Monday [Details Inside]

![Financial Modeling School Coming on Monday [Details Inside]](https://cache.excelschool.in/img/fin-school-msg1.2.png)

Financial modeling is a no catwalk. You can not look pretty, wear ridiculous outfits and expect to find if a project is worth investing money in. That is why I am very happy to announce Financial Modeling School.

Please read this short post to learn more about the program.

Continue »