In October 2008, I have started an ambitious series of posts on this blog called – Spreadcheats. These are little tricks, nuggets, tutorials on using Excel that would make anyone a spreadsheet guru.

In October 2008, I have started an ambitious series of posts on this blog called – Spreadcheats. These are little tricks, nuggets, tutorials on using Excel that would make anyone a spreadsheet guru.

The spreadcheats series has been wildly successful. I am compiling all this useful information and articles in to one big post so that anyone can follow the links and become good in Excel. Read on,

[Note: This is not for beginners. If you know what a formula is, you would enjoy this 31 articles]

1: Insert Line Breaks in a Cell

Press ALT+Enter keys in a cell to make a new line inside the cell. [Read this]

2: Select all cells in a range

Use these keyboard shortcuts to select all the cells in a range or group. You can find 90 more shortcuts on that page. [Read this]

3: Using Mouse in Excel

Many of us know at few keyboard shortcuts. But what about mouse short-cuts? Read this post to learn interesting mouse shortcuts that can boost your productivity. [Read this]

4: Using Mouse in Excel – Part 2

In the second part of Mouse shortcuts, we explore double click tricks in Excel. [Read this]

5: Save time by using chart templates

In this spreadcheat, learn how to make your own chart templates and re-use them to save time. [Read this]

6: Make ToC (Table of Contents) in Excel – and other tricks

We all run in to large excel workbooks one time or other. Read this post to find out how you can manage when you have a large file. [Read this]

7: How to print spreadsheets one just one page?

Use the little trick in print settings to print any worksheet on just one page. [Read this]

8: Write better formulas by knowing the difference between relative and absolute references

Quick, what is the difference between A1 and $A$1? If you said 2 dollars, you are the right person to read this article. Learning the differences and usages of various reference types in Excel is important if you want to write better and simpler formulas. [Read this]

9: Remove duplicate items using formulas

Learn how to remove duplicates, identify unique values etc. using formulas in this article. [Read this]

10: Introduction to VLOOKUP Formula (and MATCH, OFFSET Formulas)

VLOOKUP remains one of the most important and very useful formulas in Excel. Learn how to write vlookup formulas by reading this article. [Read this]

11: Introduction to 3D References in Excel (a tutorial on Employee Satisfaction Surveys in Excel)

In this tutorial, we will explore a feature called 3D References in Excel and build an employee satisfaction survey form in Excel. [Read this]

12: Introduction to SUMPRODUCT formula

Learn how to use SUMPRODUCT to find sum of values that meet more than one condition. [Read this]

13: Introduction to ROWS and COLUMNS formulas

One of my recent favorites, ROWS() formula is very useful to generate sequential numbers in Excel. [Read this]

14: Calculate Moving Average in Excel

Use excel formulas and relative references to calculate moving average from your data. [Read this]

15: Introduction to FREQUENCY formula

We use FREQUENCY formula in Excel to generate statistical distribution of a set of values in this example. [Read this]

16: How to understand and fix excel formula errors

If you are ever perplexed by #N/A, #NAME! and said #$#@ to excel, this is the article for you. Read it to learn what these errors actually mean and how to fix them. [Read this]

17: Quick tip to Debug Complex Excel Formulas

Use Function key F9 to debug lengthy and complex excel formulas. Select a portion of the formula and press F9 to instantly evaluate that portion and see the result. Read this article to find out how to use this trick. [Read this]

18: Use Find / Replace tool to change formulas

Learn how to use Find / Replace tool in Excel to quickly edit formulas and change them. [Read this]

19: Introduction to COUNTIF and SUMIF Formulas

COUNTIF and SUMIF are very simple yet very powerful formula tools for anyone using Excel. In this article, explore these formulas and learn to use them. [Read this]

20: Introduction to Array Formulas in Excel

Array formula is like a mega formula that would work on an entire range of cells and return another range of cells. They are useful for scenarios where the output we need is not one value but a set of values. In this introductory example, learn how to write your first array formula. [Read this]

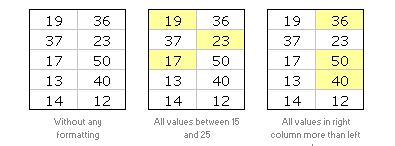

21: Introduction to Excel Conditional Formatting

Excel conditional formatting is your way of telling excel to highlight / change formatting of cells that meet certain criteria. This is a good way to draw attention to few points from a large table. Learn how to use Excel CF in this introductory article. [Read this]

22: Introduction to Excel Camera Tool

In this article, learn about Excel Camera (or Snapshot) tool which is useful for making a live snapshot of a range of cells. [Read this]

23: Introduction to Excel Pivot Tables

Pivot tables are a powerful way to analyze and report your data. In this introductory post, you will find all the basics of pivot tables and learn some tricks. [Read this]

24: Introduction to Excel Goal Seek

Goal Seek is opposite of formulas. In formulas we tell excel a bunch of values and excel finds the result. In goal seek, we tell excel what the result should and excel tells us what kind of parameters should be given. This is useful to find, for eg. Your retirement nest egg value … [Read this]

25: Introduction to Combination Charts in Excel

Learn how to combine 2 different chart types in to one chart in this article. [Read this]

26: Make a Dynamic / Interactive Chart using Data Filters

Do you know that we can use data filters to filter charts as well as data? Well, in this article, you can learn a powerful yet simple trick to make a dynamic chart in Excel using data filters alone. [Read this]

27: Make a Dynamic / Interactive Chart using INDEX Formula

Learn how to set up a dynamic or interactive chart using INDEX formula and Camera tool in Excel. [Read this]

28: Make Collapsible Charts using Group – Outline Tools

We can collapse / expand charts using the group and outline tools in Excel. Learn how to set up such a collapsible chart in Excel. [Read this]

29: Showing Chart Labels in Different Colors – Charting Tricks

Learn how to use custom cell formatting codes to show chart labels in different colors based on a criteria. [Read this]

30: Advanced Data Validation Tricks in Excel – Part 1

In part 1 of excel data validation tricks, we will learn how to use excel formulas to control the way data validation works. [Read this]

31: Advanced Data Validation Tricks in Excel – Part 2

In part 2 of data validation tricks, we will learn how to prevent duplicate data entry using data validation formulas. [Read this]

Happy learning 🙂

12 Responses to “Analyzing Search Keywords using Excel : Array Formulas in Real Life”

Very interesting Chandoo, as always. Personally I find endless uses for formulae such as {=sum(if(B$2:B$5=$A2,$C$2$C$5))}, just the flexibility in absolute and relative relative referencing and multiple conditions gives it the edge over dsum and others methods.

I've added to my blog a piece on SQL in VBA that I think might be of interest to you http://aviatormonkey.wordpress.com/2009/02/10/lesson-one-sql-in-vba/ . It's a bit techie, but I think you might like it.

Keep up the good work, aviatormonkey

Hi Chandoo,

You might find this coded solution I posted on a forum interesting.

http://www.excelforum.com/excel-programming/680810-create-tag-cloud-in-vba-possible.html

[...] under certain circumstances. One of the tips involved arranging search keywords in excel using Array Forumlas. Basically, if you need to know how frequent a word or group of keywords appear, you can use this [...]

@Aviatormonkey: Thanks for sharing the url. I found it a bit technical.. but very interesting.

@Andy: Looks like Jarad, the person who emailed me this problem has posted the same in excelforum too. Very good solution btw...

Realy great article

"You can take this basic model and extend it to include parameters like number of searches each key phrase has, how long the users stay on the site etc. to enhance the way tag cloud is generated and colored."

How would you go about doing this? I think it would need some VB

Hi,

I found the usage very interesting, but is giving me hard time because the LENs formula that use ranges are not considering the full range, in other words, the LEN formula is only bringing results from the respective "line" cell.

Using the example, when I place the formula to calculate the frequency for "windows" brings me only 1 result, not 11 as displayed in the example. It seems that the LEN formula using ranges is considering the respective line within the range, not the full range.

Any hint?

@Thiago

You have to enter the formula as an Array Formula

Enter the Formula and press Ctrl+Shift+Enter

Not just Enter

Thank you, Hui! I couldn't work out how this didn't work

is there a limit to the number of lines it can analyse.

Ie i am trying to get this to work on a list of sentances 1500 long.

@Gary

In Excel 2010/2013 Excel is only limited by available memory,

So just give it a go

As always try on a copy of the file first if you have any doubts

Apologies if I am missing something, but coudn't getting frequency be easier with Countif formula. Something like this - COUNTIF(Range with text,"*"&_cell with keyword_&"*")

Apologies if I missed, but what is the Array Formula to:

1. Analyze a list of URL's or a list of word phrases to understand frequency;

2. List in a nearby column from most used words to least used words;

3. Next to the list of words the count of occurrences.