All articles in 'Financial Modeling' Category

Scenario Analysis for the Project Valuation [Financial Modeling]

![Scenario Analysis for the Project Valuation [Financial Modeling]](https://chandoo.org/wp/wp-content/uploads/2011/07/clip_image004_thumb.jpg)

Few months ago, we learned how to create a project valuation model in Excel as part of our series on Financial Modeling in Excel.

My Project Evaluation Model had a limitation!! In one of the personal comments that I received, the reader pointed out an important problem!

Continue »Accumulated Depreciation using Mixed References

Last time we had discussed the use of SumProduct() to ease your life for calculation of consolidated revenues and depreciation. This time we would be using the sum function! Yes you heard it right – The Sum function.

But we would use the Sum function with a small trick! We would use it to calculate running cumulative sum! And believe me, you would need this function so many times – to calculate accumulated depreciation, cumulative debt, Profits to Retained Earnings and almost all the accounts that would consolidate into the balance sheet.

Continue »Details about our Financial Modeling Class

Hi there,

Do you know that Chandoo.org run an online training program on Financial Modeling & Project Finance Modeling?

So far, we have trained more than 200 students thru this program and now, I am excited to announce that from July 27th, you can join this course again.

Read this short post to understand how our program can benefit you.

Continue »Sumproduct function to Consolidate Revenues?

Chandoo.org is all about simplifying life using Excel. When I first started visiting the site, I was amazed at the amount of information on the site, which made your life easier. My next few posts would be about excel functions which can make your life for Financial Modeling easier! These are simple examples that you […]

Continue »NPV() function to calculate Present Value

Today, let us learn how to use NPV() function in Excel & create a simple financial model.

If you are dealing with cash and valuations, you are bound to have come across the NPV function. If you don’t know the assumptions behind the same, I bet it could cost you your job!

Let’s take a simple project – You buy a MSFT stock for USD 100. You receive a dividend of USD 10 in the first year, USD 20 in the second year, USD 40 in the third year and then you sell it out for USD 140. If you could have alternatively put this money in bank at 10% interest rate, have you gained anything?

How do you model this in excel? In this tutorial we understand how you can use NPV to do this analysis and what kind of pitfalls you can land into!!

Continue »Register for our Excel & Financial Modeling Bootcamp in Singapore [Details inside]

![Register for our Excel & Financial Modeling Bootcamp in Singapore [Details inside]](https://img.chandoo.org/speaking/singapore-excel-bootcamp-thumb.jpg)

Hello Friends & Readers,

Our Singapore Excel & Financial Modeling Boot-camp is ready for your consideration.

We will be conducting it from July 8th to 10th.

Please read this short page to know details about the program and how to enroll.

Who is this boot-camp for?

This boot-camp is aimed at business analysts, financial analysts & managers, who use Excel all the time. If you are an Excel new-bie, this boot-camp is not for you. Otherwise, you will enjoy this.

Continue »Do you want to attend an Excel Workshop in Singapore? [Survey]

![Do you want to attend an Excel Workshop in Singapore? [Survey]](https://chandoo.org/img/speaking/singapore-excel-bootcamp-thumb.jpg)

I have happy news for you.

Paramdeep (from Financial Modeling School) and I am going to organize an Excel Workshop in Singapore during first (or second) week of July.

We want to know if you are interested in this. So please take a few minutes and go thru this small post.

Who is this workshop for?

If you are a financial or business analyst, this workshop is for you. We will be discussing various Excel & Financial Modeling topics during the 12 hour workshop (spread across 2-3 days)

Continue »Mod() function in excel to Implement Escalation Frequency [Financial Modeling Tutorials]

![Mod() function in excel to Implement Escalation Frequency [Financial Modeling Tutorials]](https://chandoo.org/wp/wp-content/uploads/2011/04/EscalationFrequency.gif)

You take an apartment on rent at $1000 per month and the owner puts an escalation clause saying 10% increment each 3 years. How do you model this in excel? In this tutorial we understand how escalations at certain frequency can be implemented using the mod function in excel. What is the mod() function Simply […]

Continue »Financial Modeling School is closing in a Few Hours – Join Now!

I have a quick announcement for you.

As you may know, we have re-opened registrations for our 2nd batch of Financial Modeling School on Feb 23rd. We will be closing the doors for new students tonight at 11:59 pacific time. Thank you so much for supporting this program enthusiastically.

As you may know, we have re-opened registrations for our 2nd batch of Financial Modeling School on Feb 23rd. We will be closing the doors for new students tonight at 11:59 pacific time. Thank you so much for supporting this program enthusiastically.

If you wish to join Financial Modeling School, click here.

Continue »

Many of us want to learn advanced Excel and make progress in our career. But how to do it? In this post, I show 3+1 ways in which you can learn advanced excel.

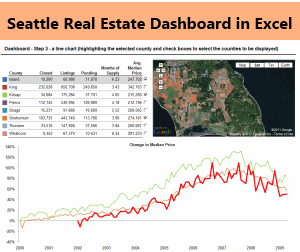

Last week I did an interview with Robert Mundigl of clearlyandsimply.com. Robert is an Excel wizard. You may know him thru the KPI Dashboard articles he has written on chandoo.org a while ago.

We spent about 90 minutes discussing some really cool & advanced Excel stuff. The interview will be available shortly on Excel School for our Dashboard students. But here is a snapshot of the dashboard we discussed in the interview. Robert taught me how to make such a dashboard using Excel.

Continue »Financial Modeling School is Open, Please Join Today

Hi my friends & readers of chandoo.org,

I have an exciting news for you. We have just opened the doors for our financial modeling course.

Please click here to learn more about the program & join.

What is Financial Modeling School?

This is an online training program for financial modeling, project finance modeling. I have partnered with Pristine Education, a company in India that specializes in Financial Modeling training to conduct this program.

This program is aimed at investment bankers, financial analysts, commercial bankers, equity research associates, project managers, sponsors, real estate project managers etc. to help them understand the nuances of project finance, financial modeling and create complex financial models using MS Excel.

Read rest of this post to learn more about the program.

Continue »Details about upcoming Financial Modeling School

We are opening Financial Modeling School for 2nd batch of classes on 23rd February. It feels very exciting to re-run this successful program. I want to share a few details about the program so that those of you interested to join can know more about it.

Please read this short post to learn 10 things about the financial modeling school program.

Continue »Modeling Interest During Construction (IDC) – Excel Project Finance

In the second part of our series on project finance using Excel, Paramdeep tells us how to model “interest during construction” in real estate and construction type of projects. We take a case of hospital construction and learn how to calculate the IDC using circular references.

You can also download both blank and completed model so that you can test the skills.

Continue »Introduction to Project Finance Modeling in Excel

This is a guest post written by Paramdeep from Pristine. Chandoo.org runs Financial Modeling School program in partnership with Pristine Careers. Visit Financial Modeling School to learn more and sign-up for our newsletter.

Greetings!

It’s been long time since we interacted on Chandoo.org. Actually I was very busy teaching the 105 awesome students for financial modeling in Excel. We all worked together to create some easy and some complex financial models. I found the journey to be quite exciting and enriching (From the feedback that I got, my students too didn’t find it bad either 😉 )

During the interaction, I found that a lot of students were looking for financial modeling around the project financing as well. So we thought why not introduce financial modeling for project finance.

In this post I will speak about some of the key aspects of a project finance model and why it can be different from modeling a normal company.

Continue »Financial Modeling School Closing in a Few Hours – Join Now!

I have a quick announcement for you.

As you may know, I am running an Online Financial Modeling Training Program called as Financial Modeling School in collaboration with Pristine Education. We have opened registrations for first batch of this program on October 18th. Thank you very much for supporting this program wildly. In a few hours, I will be closing the registrations for Financial Modeling School.

Click here to sign up for Financial Modeling School

Continue »