All articles in 'Financial Modeling' Category

Best Practice Modeling – Make these 5 changes today

Our guest author, Myles Arnott discusses what Best Practice Modeling is and offers 5 practical, easy to implement tips to get you started.

Best Practice Tip #1: Apply a modeling life cycle

Best Practice Tip #2: Give structure to your spreadsheets

Best Practice Tip #3: Make cells consistent based on their behavior

Best Practice Tip #4: Use similar formulas

Best Practice Tip #5: Build error checks in to your models

Read on…

Continue »Financial Modeling School Price Hike from Tomorrow

Hi there,

How was your weekend? We had lovely weather. So spent most of the time playing with kids, running some errands & relaxing.

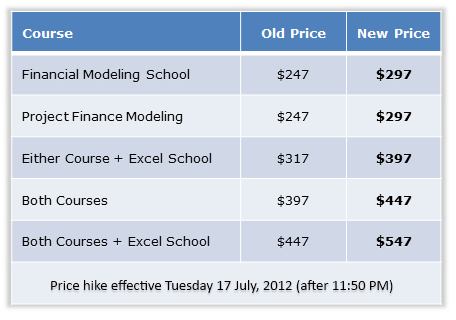

I just want to give you a quick update about our Financial Modeling School. We will be hiking course fees for this program starting tomorrow midnight (Tuesday, 17 July – 11:50 Pacific Time).

If you have been considering to join this program, please go ahead and enroll now to save money.

Click here for course details & Sign-up instructions.

Continue »Join our Financial Modeling Class before fee hike [Quick update]

![Join our Financial Modeling Class before fee hike [Quick update]](https://img.chandoo.org/fm/financial-modeling-fee-hike.png)

Hello lovelies,

I have a quick announcement to make. As you know, we run 2 online courses on Financial Modeling.

1) Financial Modeling School

2) Project Finance Modeling School

After running them for almost 2 years, we are now planning to hike the fees by $50. See below table to know about new fees.

Continue »Creating Cash Flow Statement by Indirect Method – II

So what’s the cash with Facebook? Last time, we announced the launch of a new module on getting the cash flow statement in our financial modelling course and also discussed the procedure to create the cash flow statement. I had shared with you the template for financial statements for Facebook. I had asked you to implement the steps and create the cash flow model for Facebook!

We know that the devil is in the details. Last time we discussed the process and in this post, we would implement the cash flow statement for Facebook using the indirect method.

Continue »Creating Cash Flow Statement by Indirect Method – I

If there was a challenge in any Finance 101 course at any B School, I think Creating the Cash Flow Statement would score the max. When I was pursuing my MBA, the biggest enigma for me was to go from the Balance Sheet and Income Statement to the Cash Flow statement via the indirect route. I could never get it right!

There were two challenges, the bigger was obviously unclear concepts plus I didn’t know how to play with Excel! I have worked hard on both and let me show you, how they can be used to get the right cash flow statement in no time!

Actually the concept is simple and excel makes it run on steroids!

Continue »

Project Managers often report financial numbers to the management. In a dynamic world, these numbers are usually based on a lot of factors that may or may not be under your control. So the top management demands that the numbers be reported as per different economic scenarios – Optimistic, Normal or Pessimistic. It is important […]

Continue »Using external software packages to manage your spreadsheet risk [Part 4 of 4]

![Using external software packages to manage your spreadsheet risk [Part 4 of 4]](https://img.chandoo.org/g/spreadsheet-risk-management.png)

Background – Spreadsheet Risk Management

In the Managing Spreadsheet Risk series so far we have looked at the concept of spreadsheet risk and how to manage it both at a company level and at a spreadsheet level using Excel functionality. In this final article we are going to have a quick look at an example of spreadsheet auditing software.

What to look for in a Spreadsheet Risk Management Software

First off I should state that there is a wide range of spreadsheet auditing solutions in the marketplace of different types and styles and at a variety of costs. In this section I would like to take a little time to explain the criteria we applied when we were sourcing auditing software.

Continue »Excel’s Auditing Functions [Spreadsheet Risk Management – Part 3 of 4]

![Excel’s Auditing Functions [Spreadsheet Risk Management – Part 3 of 4]](https://chandoo.org/img/g/spreadsheet-risk-management.png)

This series of articles will give you an overview of how to manage spreadsheet risk. These articles are written by Myles Arnott from Excel Audit Part 1: An Introduction to managing spreadsheet risk Part 2: How companies can manage their spreadsheet risk Part 3: Excel’s auditing functions Part 4: Using external software packages to manage […]

Continue »How Companies Can Manage Spreadsheet Risk [Part 2 of 4]

![How Companies Can Manage Spreadsheet Risk [Part 2 of 4]](https://chandoo.org/img/g/spreadsheet-risk-management.png)

In the second installment on Excel Spreadsheet Risk Management, Myles takes a look at How companies can manage spreadsheet risk?.

He tells us, how we can set a formal governance framework to reduce or mitigate spreadsheet risk. Go ahead and read. And please tell us how your company manages spreadsheet risk in comments.

Continue »Have you created models which run into 20 – 30 years? You might have noticed that navigating to the last year (the last column) is probably the most boring part (and also the most time consuming part). Excel does provide you a shortcut (Ctrl + end), but that hardly works! It’s been a while since […]

Continue »Introduction to Spreadsheet Risk Management

This series of articles will give you an overview of how to manage spreadsheet risk. These articles are written by Myles Arnott from Excel Audit

Part 1: An Introduction to managing spreadsheet risk

Part 2: How companies can manage their spreadsheet risk

Part 3: Excel’s auditing functions

Part 4: Using external software packages to manage your spreadsheet risk

The potential impact of spreadsheet error hit the UK business news recently after a mistake in a spreadsheet resulted in outsourcing specialist Mouchel issuing a major profits warning and sparked the resignation of its chief executive. Over the next few weeks we will look at the risk spreadsheets can introduce to an organisation and the steps that can be taken to minimise this risk.

Continue »Maintenance Work Complete

Maintenance on the 18 month old, Data Tables, Monte-Carlo Simulations and Fractals in Excel – A Comprehensive Guide has been completed.

Continue »Offset() function to Calculate IRR for Dynamic Range

Offset() function to Calculate IRR for Dynamic Range When you start the project can you be sure, for how long will you operate it? A VC gives you funds to buy a commercial project. You are to operate the project for some time and then sell it off! Can you tell me today, when you […]

Continue »

On a cup of green tea with a friend I grabbed the golden rule of accounting. It is simple (You can easily miss if it came your way!) and can be applied to almost all the accounts (Depreciation, Gross Block, Cash, Equity, Debt) – You name it, and you have to use it! So concentrate […]

Continue »Financial Modeling School is Open, Please Join Today!

Hello friends & readers of Chandoo.org,

I am very excited to tell you that our financial modeling & project finance classes are open for registration starting today.

In this article, you can learn about our training program, how it can help you & payment instructions.

Continue »