There are some charts that look so stunning and yet confusing. You cant make up your mind whether it tells a compelling story or it is just plain wrong.

Today, let me present you one such chart. I call this Pie of a Pie of a Pie chart (source: thiswoo, thanks to Nassar, our forum member for mentioning this)

Pie of pie of pie – What is good about it?

The idea of this chart is quite noble. Show how the water in this world is distributed. Obviously, with such large numbers, making one chart would be difficult. So make 3. The initial pie of salt vs. fresh water, which explodes to show the distribution of fresh water which explodes to show the spread of other water sources.

The chart narrates the story of how little water is available for consumption and where it is one simple picture.

And the pie leaking in to another pie metaphor works really well in this case.

What is not good about it?

To begin with, the 3D pies are very deceptive. It is not clear how much % of water is fresh water (other than the fact that it is very little). Also, compared to a 2d pie, the fresh water slice in 3d pie looks bigger (due to its orientation and 3d effects).

Then, no matter how good the colors are, the 2nd and 3rd pies are confusing. The colors imply that the blue slice (fresh water) corresponds to just ice caps and glaciers.

Since all 3 pies are of similar sizes, we immediately think that we have enough water. Only on closer inspection it becomes obvious that the size of lower pies has no relation to actual water amount (only angles convey the information).

Finally, I think this chart is bad because it takes excessively large amount of time to make in almost any software. That said, it is a good exercise to come up with this tinkering with various drawing shapes etc.

Aren’t there any alternatives?

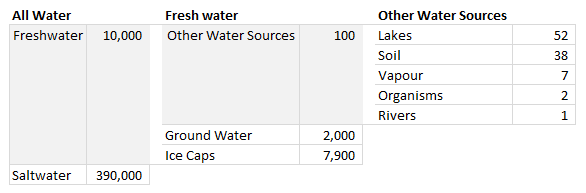

The easiest and clear (and obviously not so exciting as pie of pie of pie chart) alternative is to just show the numbers like this:

Note: This table too is misleading as row heights wrongly indicate that we have more fresh water than salt water etc.

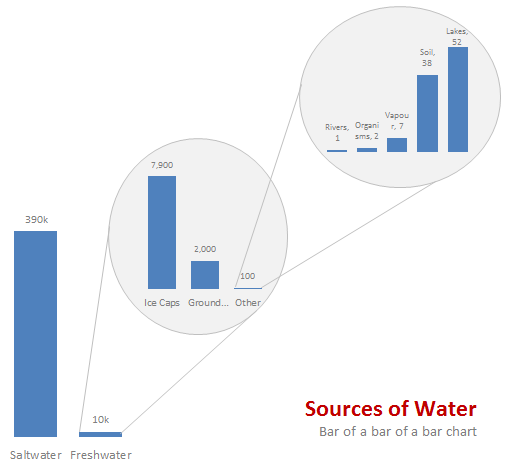

The next option is to use a variation of bar of bars, some thing like this:

One more option I can think of is a tree map. For hierarchical data like this Treemaps are also a very good option. That said, since the largest value is 390,000 times the smallest value, any treemap will be very large to show the smallest value clearly.

Do you like Pie of Pie of Pie chart?

What do you think? Do you love this or would you prefer some other chart to visualize this data? Share your opinion using comments.

Previously on Pie Charts

Pie charts are one of the most (mis)used charts in business world these days. That is why we talk about them from time to time. See these articles to learn more:

- An example where pie charts work well

- Alternatives to Pie charts

- Group smaller slices in pie charts to improve readability

- Do not make pie charts like these

PS: If you want to know to create this pie of pie of pie chart in excel, see here.

37 Responses to “Pie of a Pie of a Pie chart [Good or Bad?]”

If I could have the same quality of graphics and illustration in Office Apps, I would certainly use it.

If I could have the same quality of graphics in Office Apps (Excel, PPT) I would certainly use it.

Chandoo,

First, let me say I love your blog. I like this post, and I think that technically (in terms of readability of data) your argument is correct. The bar of bars, and the table, are much better for readability and accuracy, and as you say would be much easier to produce.

But these points ignore the context of the chart. If the chart was part of a scientific paper, your solution would be a valid one. The context in this case is an illustrated atlas of wildlife. A companion graphic to go with written text. The importance of aesthetic goes up over readability and accuracy. Much of the data and points (I assume) will be covered in the text.

There's always a pure technical tufte-esque argument. But I sometimes think it ignores the value of aesthetics. (Which I admit are quite subjective)

Great post though. Thanks.

The Treemap makes the scope of the data much clearer! The 3D pie chart depiction is deceptive.

This reminds me of the videos ive seen on the internet where it compares the relative sizes of the earth with the larger planets, then the sun, then other stars in the galaxy. Eventually there is an image showing the largest star in the sky with a little pixel representing the sun.

My point is if you varied the size of the charts it would help convey the message. The first chart (salt vs fresh) would be the biggest and the rest would be arranged in descending order. I feel this would be more accurate.

It may be helpful to consider the advice of Steven Few and Edward Tufte regarding pie charts in general. To summarize, they are seldom the most useful way to present data. Here's Few's thoughtful piece on the subject.

http://www.perceptualedge.com/articles/08-21-07.pdf

Try putting the percentages on the bar charts instead of actual amounts. Lakewater would be .013 % instead of 52.

That is very good pie chart example.

Please send example file if it is possible.

It will work , even though colors may be confusing , it can be labeled well . Also it can be called as the drilled chart , as it drills in information further , like the first chart may show business in a region , second may drill into a particular region , thrid may further drill into wat products are there in that region . It works well for me , i would more vote for the 2 nd option .

Overall all this site is awesome ,

p.s : just like me

The risk with pie of a pie of a pie chart is that Jon may have a seizure by looking at it. Also, it isn't easy to read. 😉

I dunno. The only thing worse than a pie chart is a cascading series of pie charts. I don't even think they really lend themselves to this sort of thing. It just becomes a big hide-the-ball game with your viewer.

Those goofy connectors between the pies are pure chart junk. I can't really tell if the second chart has 2 series or 3 - because the connector is a different color than the 2 labeled slices. Despite that, even whereas the drill down kind of works, still the individual components suffer from the same old weaknesses that 3d pie charts have.

Use a large bar chart as your "cover story", and fill in the sub points with smaller bar charts - or even go grab the Fabrice SFE project for extra butter. Use page orientation, color, and some text styles to guide your audience through the drill downs.

FWIW, if you check out the guy's site, you can find several other truly mortifying charts:

http://www.andrewdavies.com.au/index.html

The methane emissions one is particularly heinous. Although, I'm kind of debating what I think about the 'Glacier Changes" chart. I'd kind of like to see the data on that to see how it would look in a more traditional horizon chart.

Thank you, that was scary. I don't understand the "Glacier changes" Chart at all...

Its a very nice way to represent the data, especially when we have sets and sub-sets within the data.

I like these!

Except for the fact that they aren't dynamic and hence must be setup manually each time

It would also be nice if they could be interrogated as in select a different segment and the new data falls out automagically, but then none of the standard Excel charts do that either.

I'd like it better if the bars were stacked. How about this idea (I hope I can convey it in words):

First bar is vertical and stacked.

Second bar is horizontal, stacked horizontally and the same proportion had it been on the first bar.

Third bar is vertical, stacked vertically and the same proportion had it been on the second bar.

Then it would really look like you are zooming on the chart, like the Powers of Ten video, or maybe like the golden ration spiral.

These looks shunting but setting up for each step makes kicks them out. However if these can be arranged automatically by native excel or by VBA, these will be the part of my "Archery"

I agree with Chandoo's Suggestion about the Bar Graph which represents data in a very appropriate manner. Even I prefer doing the same. I seldom use Pie Chart unless required.

That's a real nice example of a missleading infographic. But to be honest, I think chandoos suggestion is not much better!

Why are pie charts bad? I think because they don't show the real size-relations. The biggest pie in that example ist 300k big. The 2nd one has only the size of 10k, about 3% of the first one. Niether the pies nor the bars show the real sizes. I jnow, it's hard to show the sizes because the values of the second and the third pie are so small. But that's what visualization are about - showing relations to allow the reader to see the real sizes!

So how to show the real figures?

First possibility is o use a 1:1 scaling. Well then, you need a very big screen to show also after a 90° rotation, wihich I would prefer because it's a structural comparison and not a timeline. Maybe that solution is not the perfect way.

The other chance you have is to zoom in but to really show that you zoom in! http://www.pro-chart.de/images/Water_Fall.png maybe gives you a first impression what i mean. (i was a quick try, done in 10 minutes)

The next way is, maybe to fold the bars like in the financial report 2011 of the Post of Switzerland page 22. That chart is based on an excel chart. Maybe can explain you how to do it 😉

Financial Statement: http://www.post.ch/en/post-startseite/post-berichterstattung/post-berichterstattung-service/post-berichterstattung-downloads/post-gb-2011-finanzbericht.pdf

page 22: http://www.pro-chart.de/images/FS_Schweizer_Post.png

A way that is not so very common is to divide the bars in a lot of single datapoints. So maybe the 390k bar then consists of about 5,000 single datapoint. That's not possible - it is! Have a look:

http://www.pro-chart.de/images/Dotted_WF.png

It's pure excel!

Now one single point ist 0,2% of the whole (in the example above). Add more datapoints and you can visulize the very big and the very small numbers!

Wish you a lot of fun - visualizing with excel can be very powerful!

Joerg

...if you would like to know how these charts work, just send an email to J.Decker@pro-chart.de

Hey Joerg,

I don't dig so much the dotted waterfall thing. But this is kind of awesome:

http://www.pro-chart.de/images/FS_Schweizer_Post.png

Can you help me on the bar of bar graph? Would it be possible to create that from pivot table? Can you show me how to create the bar of bar graph?

do nothing but say "Awesome!"

You are a Rock star.....This seemed an answer as if someone was reading my mind and just had the solution to my questions on what I exactly was looking for .....What a Fab !!

can u explian me step by step

Can anyone please explain how to make this chart please.

Do you mean the pie of a pie chart or the folded bar chart?

Joery PIE OF PIE Chart please

Can someone please explain how to make PIE OF PIE Chart.

@Mandeep

The last line of the post is:

PS: If you want to know to create this pie of pie of pie chart in excel, see here.

Due to forum migration, link is now:

http://chandoo.org/forum/threads/multiple-pie-chart.7343/

Hi... i love these charts.... can any one show me how to draw these charts in excel 2010

@Vamshi

The very last line of the post refers you to:

PS: If you want to know to create this pie of pie of pie chart in excel, see here. http://chandoo.org/forums/topic/multiple-pie-cahrt

Where is the attachment....it used to be there...i have seen this before but now i am not able to find...

See this:

http://img.chandoo.org/playground/WaterDistribution-chandoo.xlsx

And this:

http://chandoo.org/forum/threads/how-do-you-create-this-chart.9743/

Normally I don't learn post on blogs, however I would like to

say that this write-up very compelled me to try and do so!

Your writing style has been amazed me. Thank you,

quite great article.

This is very impressive, I would like to learn how to build this for myself. I have tried for some time now, is there a step by step process on how to create these waterfall pie of pie charts?

I am novice to excel and use it very seldom. But your blog contains to the point information one needs to get going.

I was searching for a trick to do a Pie chart drill down - for example the first pie chart shows how the prices are distributed between perishable and non-perishable items.

Now if we want to know how the perishable items are distributed - one can click the segment and it will draw another pie chart with distribution of all different perishable items (milk,meat,fruit,veg etc)

So do you have any such trick?

Regards,

electrojit

I like the look of your pie of pie of pie chart, although I understand that the relative size of each pie does not represent the actual percentages.