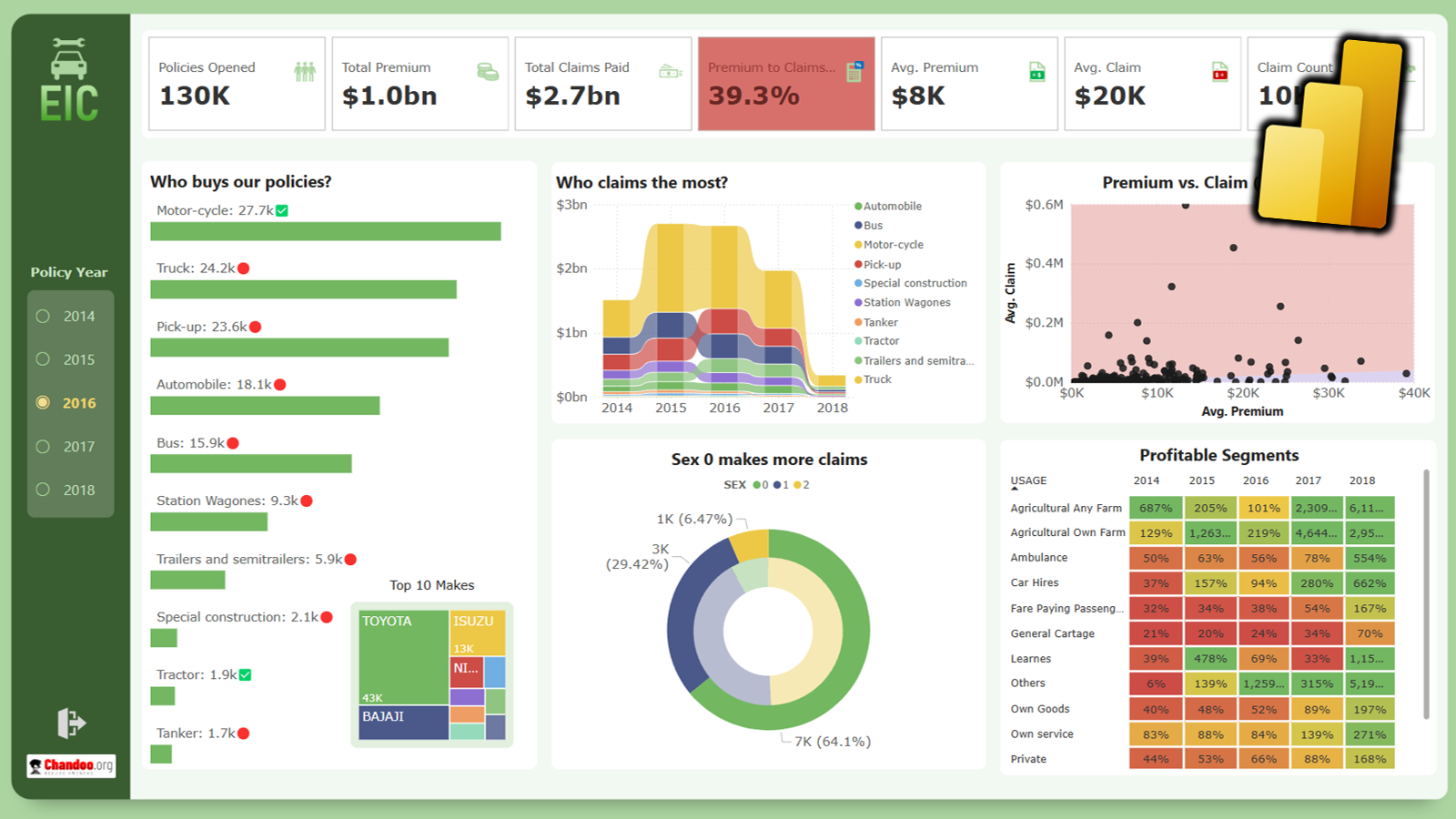

Introducing Power BI Play Date online class [Details inside]

Hello,

I have an exciting news for you. After learning and playing with Power BI for more than a year, I would love to share all this awesomeness with you on a play date. Of course, you don’t have to pack your sleeping bag and tooth brush. You can join me on this play date from the comfort of your couch and PJs. Stoked? Read on.