Splitting an Excel file in to many is easier than splitting bill in a restaurant among friends. All you need is advanced filters, a few lines of VBA code and some data. You can go splitting in no time.

Context:

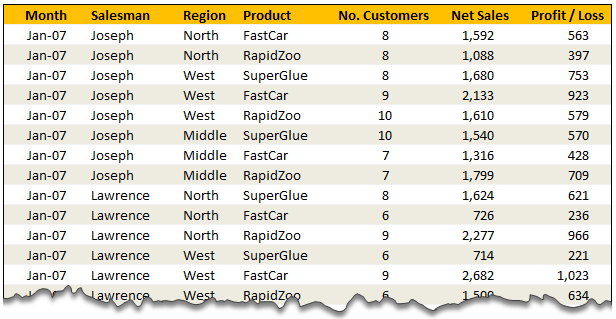

Lets say you have lots of data like this in a file. And you want to split this in to multiple files, one per salesperson.

Solution – Split Data in to Multiple Files using Advanced Filters & VBA

The process of splitting data can be broken down to 4 steps.

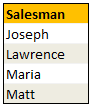

- Identify the split criteria and list down all values in a small range. In our case, we list all the salespersons names in a named range lstSalesman.

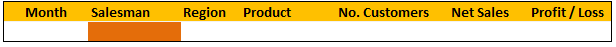

- Set up advanced filters so that we can filter the data by one salesman at a time.

- Now, for each salesman, apply advanced filters and set it to copy the filtered values elsewhere.

- Copy the filtered values

- Add a new workbook and paste the copied values there.

- Save the new workbook with a unique name

- Repeat the above 3 steps for each salesman

- That is all! You are done splitting.

Video Lesson on Splitting Data using Filters & VBA

Since splitting data in to multiple files requires a bit of macro code & advanced filter knowledge, I have created a short lesson explaining how this works. Watch it below.

[If you are not able to see the video, watch it on our Youtube Channel]

If you are new to VBA, take our crash course.

Download Split Data Example Workbook

Click here to download the split data example workbook.To use this,

- Save the downloaded file to any folder.

- Open the file and enable macros.

- Examine everything and when ready, click on “Extract” button.

- Check the folder where you saved the file and you will fine 4 new Excel workbooks named after the salespersons with the data extracted for them.

You can find the macro code in Module 1.

How do you Handle Splitting Situations?

In my work, I rarely had to split data. And whenever I had to split data, I usually copy paste the data after filtering what I want. But I can imagine many real life scenarios where you need to automate the splitting part.

How do you split data? What techniques and ideas you use to speed up the splitting process? Please share using comments.

More on Splitting & Consolidation

If you are in to splitting or combining things, we have a selection of tips & examples to help you. Check out these articles.

- Consolidating Data in Excel – a collection of techniques & tips

- Split Text on new line using VBA

- Combining Data using Excel’s Consolidate Feature

- Using 3D References to Consolidate Data

PS: Heck, we have even have an Excel tip to tell you how to split expenses among friends 😛

PPS: You can use Pivot Table Report Filters if you want to split data in to multiple sheets.

63 Responses to “To-do List with Priorities using Excel”

Very useful, you always give us good ideas for our excel files. Thanks

I've been working on calendars leagues. If you must watch a bit on my blog. http://economiaemergente.com/

EXCELLENTE!!!!

Needed .. thanks for sharing

[...] To-do List with Priorities using Excel [...]

Excellent spreadsheet. Nice work.

Ciao Peppe!, Tante grazie per compartire il tuo eccellentissimo lavoro in Excel. Tu hai a web blog? - Grazie Chandoo per la publicazione.

Hello Peppe, Thank you so much for sharing your most excellent work in Excel. Have you a web blog? - Thanks Chandoo for publication.

Hi Jose,

tanks for your appreciations and tks to Chandoo for publishing

my little job. it's a pleasure for me to be mentioned on my guru's blog.

Just to reply to Jose, I don't have a blog, but if you want to share some ideas or need some help don't hesitate to contact me also on twitter like @peppinogreco.

Regards

Peppe

Hi Peppe!

Thank you for this very useful excel spreadsheet!

Great!

I've learned a little bit of VBA during the last year, and get addicted to it, but sometimes, it makes us forget how powerful excel is, without macros.

Nice post!

Cauê

Hi Chandru,

A very good post. Though I had been reading your posts for a longer time, did not post any questions so far except for wishing and appreciating.

I have a question here. I had attempted to do something on my own (a little R & D) on the new year resolution template itself. However, I could not do it fully. Thankfully, you had provided the link for each step , which was exactly what I was looking for 🙂

I had done with the check boxes and also conditional formatting. I am glad indeed. I am able to highlight a row when a check box is checked. However, the value of the checkbox gets printed in the same cell which it was linked to. How can I avoid it ? I could not see it in the sample excel files you had provided.

I appreciate your help in this.

Cheers,

Raghavan alias Saravanan M

Jeddah | Kingdom of Saudi Arabia

Hi Raghavan... Thanks for your comments and I am glad you are trying to build this on your own. There is no way we can avoid printing the check box value in linked cell. If you do not want to see "TRUE or FALSE" in a cell, you do one of the following.

Dal Messico grazie tanti Peppe.

A great idea, thanks for shearing it with all of us.

Daniel

Lovely idea - downloading now.

What software is used to create the animated gif of the template in action? Love to replicate to simple demos on my site.

Cheers

Glen

@Glen

Chandoo uses Camtasia Studio to make the animated GIF's

You can read what else Chandoo uses here: http://chandoo.org/wp/about/what-we-use/

Cheers

I should have checked first.

G

Still defeated.

What I am looking for is the TORN edge effect as applied to the screen capture. I can see how to do this for captured images, not vidoes.

I wonder if they are post processed in some way?

Cheers

G

Sorted.

Capture white screen with torn paper edge with SnagIT

Make the inner of border transparent (Photoshop)

Add the image as an overlay in Camtasia.

Sorry to hijack an Excel thread with this - its been bugging me for a while.

G

Raghavan

I just make the font white for the cell linked to the checkbox or if you have shading applied then font colour = shading so its there but is not seen or printed.

John

Excellent! Thank you very much.

Excellent thanks!

Happy New Year.

Looks simple but excellent. Never knew you could do this without VBA.

Thanks Pepe

good day,

Please, how can I create a chart with scroll bar that is also dynamic in PPT.

I created the chart in Excel, but I need this information to be presented dynamically in powerpoint and when I put the bar rolls loses functionality. please can you help me?

Come nella migliore tradizione:grandi ma semplici idde dall'Italia.

bravo Peppe

This was outstanding. I have had two bosses give me to-do lists that I was very unhappy with. I went and added 15 more lines to this and it was really easy to so with a little reformatting and changing some links. THANKS!!!

Thanks. really usuful. Will be waiting for such thing in future.

Great tutorial! It would be interesting if someone could explain how to do the chart with detail: how to insert the values of the horizontal axis, to create the horizontal bar (the outlines) and the bar itself, etc

Hi Juan...

See this page for a tutorial on the chart - http://chandoo.org/wp/2009/12/17/quick-thermometer-chart/

[...] To-do List with Priorities using Excel [...]

Good Concept!

Downloaded it but, my Excel 2007 hangs and I have to recover it few times. Finally it opens but, everything is distorted.

Am I doing something wrong?

-DJ

Interesting idea.

You give e new way to track my actual planning.

But instead of using thermometer in this case, we can use a simple bar chart , with data is the total done.

Reasoning for that, with thermometer, you have to format all the small part of data with the same color. If you have more than 10 parts, it will take your time to finish.

I tested and it shown the same.

I'm searching for How to automatically add check box link to a new cells when we add new item?

Thanks for your interesting idea.

Thank you Peppe & Chandoo for sharing an awesome idea.

How do i increase the list ? I cant just drag down can I ? the check boxes perform the same way

VERY EXCELLENT THANK YOU VERY MUCH.

How do you increase the list? Formatting of the check boxes and shading etc does not copy correctly if using copy and paste or dragging cells down...

Thanks for this useful to do list.

I have the same question as TADOVN. This blog doesn't properly give instruction on how to add new task row. Following are my queries.

1) How do I add a new row?

2) If I copy paste the last row to create a new row, the check box get duplicated, i.e. if I click on the new check box on the new row, the previous check box also gets checked.

So the simple question is.. how do I add a new row so that it behaves the same way as other rows?

Thank you very much! Great to do list template.

Thanks for the template.

From an NGO organisation in Malaysia

Will someone please answer the question about how to add additional rows to this list? I love it, but this is a fatal flaw, as I frequently have many more tasks.

Thank you!

Below is how I added additional rows:

1) Select both columns H and N, right clicked, and clicked Unhide to reveal the formulas.

2) Select row 12 on the To Do List, copy it, and insert it below in the next row.

3) Change the 12 in cell C22 to a 13.

3) Drag your mouse and copy the formulas from cells I15, J15, and K15.

4) Paste the formulas below in cells I16, J16, and K16.

5) Right click on the check box in cell F22.

6) Click Format Control.

7) Click the Control tab.

8) In the Cell Link box, change the I15 to I16.

9) Repeat the steps above. (Change I16 in the Cell Link box to I17...I17 to I18, etc.)

10) If you are not seeing Format Control when you right click the check box, you need to make the Developer Tab available.

Leah,

If you follow my previous instructions, you still may need to go back and change the formulas in column K. They calculate the priority weights and go in consecutive order as you go down the column:

IFERROR(1/E10,0)

IFERROR(1/E11,0)

IFERROR(1/E12,0), etc.

Some of you who are more Excel savy may be able to figure out how to copy the formulas quicker. This is just the way I figured it out.

Thank you Dennis; I will try that!

I am sure I would love this and it will help me to accomplice my tasks efficiently . Thanks Buddy

How would I be able to delete one of the row (not use 6 for example) so it won't calculate it with the progress?

[…] 42,416] Angry Formulas game… [Visitors: 36,392] Learn top 10 Excel features [Visitors: 25,723] To-do list with priorities – Excel templates [Visitors: 19,947] Introduction to Power Pivot [Visitors: 21,298] Best new features in Excel 2013 […]

[…] 2013 Calendar, 2012 Calendar, 2011 Calendar, New Year Resolution Tracker, Picture Calendar Template and Todo list template […]

[…] ?? ????? ??????????? ?????? ?????? ????? ? ????????????? ??? Excel. ??? ???? ????? ?? ??? […]

Thank you so much for this post. I took me a bit to figure out how the checkboxes link to the rest of the sheet, but now that I've got it I've created a new page for every day so I can track tasks going forward. I've also added work tasks side-by-side with personal tasks. Once I did that I also thought it would be neat to see how productive I am week over week so I added a nice summery page. The summary builds on the percentage completion for personal and work tasks.

Love this template - so versatile and yet simple.

My next project is to get standard weighting for certain tasks so I don't have to keep remembering them.

Cheers,

Victor

I like this template. I may modify how the checkboxes work though for a couple reasons:

1) It's a pain to add more rows. If I want to add 10 more rows, it appears that I have to re-point each new object to the appropriate link-cell. Otherwise, they all point back to the copied row - checking one causes all of them to check.

2) I can't group and collapse rows in the checklist without all the objects stacking together and remaining visible in the lowest non-collapsed row. With a simple "x", this would be ok.

One solution would be to have a simple "x" instead of a checkbox object. I could just use an "x" to mark complete, and make the TRUE/FALSE based on an If formula (If "x" then TRUE; otherwise FALSE).

I downloaded the file, but it is a ZIP file with several subfolders and xml files. There is no workbook here. How do I open this in Excel?

thank you for the help and excellent ideas you share.

@Kris

Yes, Excel files are special Zip files that actually contain a number of files including your data

If the file opens like that save it locally as a *.zip file and rename it to a *.xlsx file

Open with excel normally

How do you change the color when it is completed....I have multiple companies and need to color code this template.

Thank you.

@S.F

Use Conditional Formatting

Hello! I have added additional rows, fixed it so that the check boxes work individually, AND made it so that the #% changes when each box is checked -- however the status bar won't move past the midway mark.

Any ideas on how I can get the progress bar to fill up the entire way once the list is complete?

If you right click the status bar, select 'Select Data' and go to 'Chart Data Range' and revise to include your expanded range. The bar chart colors may default to a predefined style. Right click the chart to reformat the Chart Area.

Or, to change the bar colors, I populated all rows w/ activities and rank and then left clicked the bar chart color that I wanted to change - went up to the ribbon under the home tab, selected the new bar color from the fill color dropdown.

Love the instant gratification of the status bar! Genius!

Thank you so much, what a great tool! God bless you for doing this for free!!

Awesome

Nice to show power of excel.

Over in the Chandoo.org Forums, Asshu has updated this witha VB Interface

Have a look and use if from: http://chandoo.org/forum/threads/to-do-list-vb-interface.28973/

Dear All,

There are good job done here & its very helpful for all.

God Bless You to you all for your valuable working.

Regards,

Chirag

Hi guys,

I've added additional rows, but the percentages in the thermo-meter don't reflect this when the boxes are checked. I'm lost with how to change this, so any assistance would be greatly appreciated!

Jake

@Jake

Can you please ask the question on the Chandoo.org Forums

https://chandoo.org/forum/

Please attach a sample file to simplify the solution

Hi Chandoo, how you do it for all this check list. it is using Excel VBA, I am not good it that.. still leaning part. and I was trying to figure out. Trying to understand all vba code and meaning and when I use which code.

do you have any guide line on this, i mean. Exp: dim is what, string etc:

for all this checking list does need to use VBA?

Thankyou

Peggy