This is a guest post written by Paramdeep from Pristine. Chandoo.org runs Financial Modeling School program in partnership with Pristine Careers. Visit Financial Modeling School to learn more and sign-up for our newsletter.

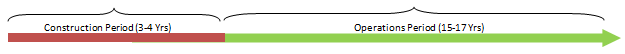

Who is not interested in buying a new house? Owning a (at least the first one) house is like a dream come true for most! If you have ever bought (or thought of buying) a house in a building that is yet to be constructed, you would realize that there are clearly two parts of the business for the developer – the construction period (which is when the building is being built for the first 2-3 years) and the operations/ sales period (after the construction, they would sell or lease the building).

As we discussed last time, one of the key aspects of any Infrastructure/ Real Estate Project is the long gestation period of the project. Typically in the construction period the project would utilize all the cash and when the operations/ sales period starts, the costs are almost zero as compared to the revenue being generated from the project.

So what’s the big deal about the cash flow structure?

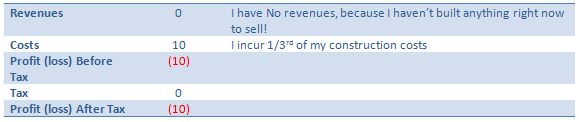

One of biggest concern in the construction period (Lets say it runs for 3 years) is that it consumes all your cash. If my total cost of building the project is going to be USD 30 Million (Spread equally over the three construction years), my Profit and Loss Statement would look something like:

P&L (all figures in USD Mi)

But my building is not yet built (hence I cannot sell it), so I can take this as a Work In Progress (WIP) to my balance sheet (more about this can be learnt from accounting books and we would also be delving into this concept in detail in our training). But one thing is for sure, I would have a cash deficit of USD 10 Mn in the first year and a similar situation would continue for the first three years (till the point construction is complete and you start selling/ operations).

Typically, these projects also have a large amount of debt. For example, if I am expecting to construct the building for USD 30 Mn, I would try to take a bank loan of at least USD 20 Mn.

If you were a bank, the decision making of whether to lend money is taken on the interest and principal repaying capacity. If as a bank I analyze your P&L, I find that you have no cash to pay me my interest and principal! Traditional bankers lend you money ONLY if you can EASILY pay me back my money (typically look at a ratio of (interest + repayment) amount to the cash generated – called coverage ratio). If you can’t do that – I will not lend!

So how do Banks view this?

As a banker, I understand that you are going to construct for 3 years and that is when you need my money (And would not be able to pay me interest). So I agree to not take interest and principal repayment as cash each year. But I cannot let go of this money!

Think of it as – I let you take additional loan to fund this payment! For example, let us assume:

Interest Rate prevailing: 10% per year

Loan amount in first year: USD 10 Mn

- So Interest on this loan: USD 1 Mn

- Now you can’t pay me back, so take additional loan (In first year itself) of USD 1 Mn

- That means total loan: USD 11 Mn (10 that you originally took and 1 that you took to pay the interest)

- That means interest is actually USD 1.1 Mn (Instead of the original 1 Mn)

- That means that effective loan: USSD 11.1 Mn (11 that we had calculated earlier and 0.1 to fund this gap)

- So interest: USD 1.11 Mn

- So effective Loan amount: USD 11.11

… and so on

There is a clear circular logic in this concept – My loan changes interest and interest changes loan

Interpreting the circular logic

Summarizing our thoughts:

- When an asset is developed, and there is a considerable period between the start of a project and its completion, the interest costs related to the construction are generally included in the cost of the asset, that is, the interest cost is capitalized

- The capitalization period ends when the asset is ready for use

- While modeling in excel, Interest During Construction (IDC) introduces a circular loop into the sheet due to the circular references explained below (1-2-3-4)

o Equity and Grant commitments can be either a specific amount, or a certain percentage of the total project funds required (that is, a fixed percentage in the capital structure)

[Tip: Learn more about Excel Circular References.]

The Case – Modeling Interest During Construction in a typical Real Estate Project

Let us consider the construction period of a project at place X, where government wants to build a hospital.

The costs of the project are stated below:

The government is ready to provide a grant of USD 50 Mn in the project and the project builder has to infuse equity of USD 100 Mn in the project

The shortfall in the funds can be funded through debt.

A complete model for financing has to be prepared for the construction period.

The Concept

The basic concept behind the model is pretty simple

Total cash outflow in a year = Total Cash Inflow in the year

- So the first step is to calculate the cash outflow in all the years. This cash outflow also includes the cost of paying the interest (which we would not know in the first pass).

- As a next step, we find the amount available to us through the equity and grants.

- We know that cash inflow has to be equal to cash outflow for all years.

- Whatever is the shortfall, we raise debt to fund it.

- Calculate the cumulative debt

- We calculate the interest on this debt.

- Whatever is the interest on the debt, we plug it back in the project cost (and hence introduce the circular logic in the model)

Step I: Getting the Cash Outflow (Project Costs)

Based on the case, calculate the cash required in each year.

We know the costs of each of the items and what should be the contribution in each year. Multiply the values to get the amounts in each year!

In the same step, we add all the costs (Including the Interest During Construction, though we don’t know it right now)

Step II: Getting the Cash Available (through Equity and Grants)

Based on the equity and grant infusion schedule, we calculate the cash inflows

Step III: Cash Inflow = Cash Outflow

Since the cash outflow has to be matched with cash inflow, we make the total project cost in all years equal to funding in the year

Step IV: Fund the shortfall through debt

Since the only source to fund the shortfall is debt, lets raise the debt as the total fund needs less whatever is available through equity and grants

Step V: Calculate the total debt outstanding

Since there is no way that we can pay the debt in the construction time, we make the outstanding debt as the cumulative debt raised (See me use a trick to accumulate!)

Step VI: Calculate the interest on the debt

Since we have taken money from the bank, we need to pay an interest on it. The interest rate is given to us, let us link the amount to the interest to calculate the interest.

Step VII: The Circular Logic (Plugging back the interest in the project cost)

Since the interest is also a cost of the project (and we are not paying it back to the bank each year), we take it to the project cost.

Out here, if you notice, excel starts a circular calculation and updates all the values! This can be verified by looking at the bottom left of excel and noticing this sign of “calculate”

Beware! Circular References can be dangerous!

What we have achieved in this tutorial is one of the most intricate concepts in project finance -Interest During Construction (IDC). We have also used a fairly advanced function in excel – Circular loops. But please note that circular loops in excel is a dangerous tool. If by chance your excel sheet gets an erroneous value, the error would propagate through the model and there is no way for the model to recover back from the error, unless you know where the circular loop is and you delete and go back from there. For example, if I change 10% interest to “ten”,

I figure that my model is corrupt (It was expecting a numeric input and I gave a string!). But I can go back to 10%, my model does not go back!!

I leave it as a homework for you to figure out, how to go back to a stable state!! 🙂

I will give you a trivial solution (close the sheet and open it again) :). You figure out, where the circular loop is and delete those lines and break it to come back!!

In the meanwhile, happy modeling!!

Project Finance Modeling – Templates to download

I have created a template for you, where the assumption numbers are given and you have to link the complete model!

You can download the same from here. You can go through the case and fill in the yellow boxes. I also recommend that you try to create this structure on your own (so that you get a hang of what information is to be recorded).

Also you can download this filled template and check, if the information you recorded, matches mine or not! 🙂

I am just doing that for the single sheet model and recommend that you do the same for multi-sheet model as a homework problem. If you face any issue, post your excel with the exact problem and we can discuss the way to move forward.

Next Steps

This series gives you a flavor of how project finance modeling is done and an idea about specific nuances in modeling for long gestation projects. I do hope to see you in the financial modeling school.

Join our Financial Modeling & Project Finance Classes

We are glad to inform that our new financial modeling & project finance modeling online class is ready for your consideration.

Please click here to learn more about the program & sign-up.

For any queries regarding the cash impact or financial modeling, feel free to put the comments in the blog or write an email to paramdeep@edupristine.com

12 Responses to “29 Excel Formula Tips for all Occasions [and proof that PHD readers truly rock]”

Some great contributions here.

Gotta love the Friday 13th formula 😀

Great tips from you all! Thanks a lot for sharing! bsamson, particularly you helped me on a terribly annoying task. 🙂

(BTW, Chandoo, it's not exactly "Find if a range is normally distributed" what my suggestion does. It checks if two proportions are statistically different. I probably gave you a bad explanation on twitter, but it'd be probably better if you fix it here... 🙂 )

Great compilation Chandoo

For the "Clean your text before you lookup"

=VLOOKUP(CLEAN(TRIM(E20)),F5:G18,2,0)

I would like to share a method to convert a number-stored-as-text before you lookup:

=VLOOKUP(E20+0,F5:G18,2,0)

@Peder, yeah, I loved that formula

@Aires: Sorry, I misunderstood your formula. Corrected the heading now.

@John.. that is a cool tip.

Hey Chandoo,

That p-value formula is really great for a statistics person like me.

What a p-value essentially is, is the probability that the results obtained from a statistical test aren't valid. So for example, if my p value is .05, there's a 5% probability that my results are wrong.

You can play with this if you install the Data Analysis Toolpak (which will perform some statistical tests for you AND provide the P Value.)

Let's say for example I've got two weeks of data (separated into columns) with the number of hours worked per day. I want to find out if the total number of hours I worked in week two were really all the different than week one.

Week1 Week2

10 11

12 9

9 10

7 8

5 8

Go to Data > Data Analysis > T-Test Assuming Unequal Variances > OK

In the Variable 1 Box, select the range of data for week 1.

In the Variable 2 Box, select the range of data for week 2.

Check "Labels"

In the Alpha box, select a value (in percentage terms) for how tolerant you are of error.

.05 is the general standard; that is to say I am willing to accept a 95% level of confidence that my result is accuarate.

Select a range output.

Excel calculates a number of results: Average (mean) for each week's data, etc.

You'll notice however that there are two P Values; one-tail and two-tail. (one tail tests are for > or .05), the number of hours I worked in week two is statistically equivalent to the number of hours I worked in week one.

So here’s a way you might want to use this. You put up a new entry on your blog. You think it’s the best entry ever! So you pull your webstats for this week and compare it to last week. You gather data for each week on the length of time a visitor spends on your website. The question you’re trying to prove statistically is whether there’s an average increase in the amount of time spent on your website this week as compared to last week (as a result of your fancy new blog post). You can run the same statistical test I illustrated above to find out. Incidentally, it matters very little to the stat test whether the quantity of visitors differs or not.

Anyhow, the Data Analysis toolpack doesn't perform a lot of stat tests that folks like me would like to have access to. In those cases I have to either use different software, or write some very complicated mathematical formulas. Having this p-value formula makes my life a LOT easier!

Thanks!

Eric~

Fantastic stuf..One line explanation is cool.

Thanks to all the contributors

OS

Take FirstName, MI, LastName in access (you can fix it to work in excel) capitalize first letter of each and lowercase the rest and add ". " if MI exists then same for last name:

Full Name: Format(Left([FirstName],1),">") & Format(Right([FirstName]),Len([FirstName])-1),"") & ". ","") & Format(Left([LastName],1),">") & Format(Right([LastName],Len([LastName])-1),"<")

I teach excel, access, etc etc for a living and i have my access students build this formula one step at a time from the inside out to show how formulas can be made even if it looks complicated. Yes I know I could just do IsNull([MI]) and reverse the order in the Iif() function but the point here is to nest as many functions as possible one by one (also I illustrate how it will fail without the Not() as it is)

Extract the month from a date

The easiest formula for this is =MONTH(a1)

It will return a 1 for January, 2 for February etc.

if in a column we write the value of total person for eg. 10 if we spent 1.33 paise each person then how we get total amount in next column and the result will in round form plzzzzz solve my problem sir................... thank u

@Anjali

If the value 10 is in B2 and 1.33 paise is in C2 the formula in D2 could be =B2*C2

If the values are a column of values you can copy the formula down by copy/paste or drag the small black handle at the bottom right corner of cell D2

kindly share with me new forumulas.

How to convert a figure like 870.70 into 870 but 871.70 into 880 using excel formula ? Please help.