This is a guest post written by Paramdeep from Pristine. Chandoo.org runs Financial Modeling School program in partnership with Pristine Careers. Visit Financial Modeling School to learn more and sign-up for our newsletter.

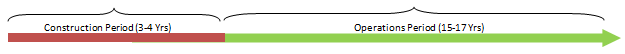

Who is not interested in buying a new house? Owning a (at least the first one) house is like a dream come true for most! If you have ever bought (or thought of buying) a house in a building that is yet to be constructed, you would realize that there are clearly two parts of the business for the developer – the construction period (which is when the building is being built for the first 2-3 years) and the operations/ sales period (after the construction, they would sell or lease the building).

As we discussed last time, one of the key aspects of any Infrastructure/ Real Estate Project is the long gestation period of the project. Typically in the construction period the project would utilize all the cash and when the operations/ sales period starts, the costs are almost zero as compared to the revenue being generated from the project.

So what’s the big deal about the cash flow structure?

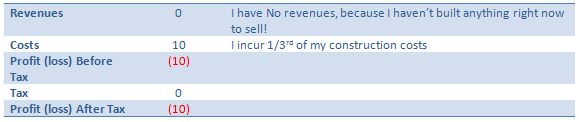

One of biggest concern in the construction period (Lets say it runs for 3 years) is that it consumes all your cash. If my total cost of building the project is going to be USD 30 Million (Spread equally over the three construction years), my Profit and Loss Statement would look something like:

P&L (all figures in USD Mi)

But my building is not yet built (hence I cannot sell it), so I can take this as a Work In Progress (WIP) to my balance sheet (more about this can be learnt from accounting books and we would also be delving into this concept in detail in our training). But one thing is for sure, I would have a cash deficit of USD 10 Mn in the first year and a similar situation would continue for the first three years (till the point construction is complete and you start selling/ operations).

Typically, these projects also have a large amount of debt. For example, if I am expecting to construct the building for USD 30 Mn, I would try to take a bank loan of at least USD 20 Mn.

If you were a bank, the decision making of whether to lend money is taken on the interest and principal repaying capacity. If as a bank I analyze your P&L, I find that you have no cash to pay me my interest and principal! Traditional bankers lend you money ONLY if you can EASILY pay me back my money (typically look at a ratio of (interest + repayment) amount to the cash generated – called coverage ratio). If you can’t do that – I will not lend!

So how do Banks view this?

As a banker, I understand that you are going to construct for 3 years and that is when you need my money (And would not be able to pay me interest). So I agree to not take interest and principal repayment as cash each year. But I cannot let go of this money!

Think of it as – I let you take additional loan to fund this payment! For example, let us assume:

Interest Rate prevailing: 10% per year

Loan amount in first year: USD 10 Mn

- So Interest on this loan: USD 1 Mn

- Now you can’t pay me back, so take additional loan (In first year itself) of USD 1 Mn

- That means total loan: USD 11 Mn (10 that you originally took and 1 that you took to pay the interest)

- That means interest is actually USD 1.1 Mn (Instead of the original 1 Mn)

- That means that effective loan: USSD 11.1 Mn (11 that we had calculated earlier and 0.1 to fund this gap)

- So interest: USD 1.11 Mn

- So effective Loan amount: USD 11.11

… and so on

There is a clear circular logic in this concept – My loan changes interest and interest changes loan

Interpreting the circular logic

Summarizing our thoughts:

- When an asset is developed, and there is a considerable period between the start of a project and its completion, the interest costs related to the construction are generally included in the cost of the asset, that is, the interest cost is capitalized

- The capitalization period ends when the asset is ready for use

- While modeling in excel, Interest During Construction (IDC) introduces a circular loop into the sheet due to the circular references explained below (1-2-3-4)

o Equity and Grant commitments can be either a specific amount, or a certain percentage of the total project funds required (that is, a fixed percentage in the capital structure)

[Tip: Learn more about Excel Circular References.]

The Case – Modeling Interest During Construction in a typical Real Estate Project

Let us consider the construction period of a project at place X, where government wants to build a hospital.

The costs of the project are stated below:

The government is ready to provide a grant of USD 50 Mn in the project and the project builder has to infuse equity of USD 100 Mn in the project

The shortfall in the funds can be funded through debt.

A complete model for financing has to be prepared for the construction period.

The Concept

The basic concept behind the model is pretty simple

Total cash outflow in a year = Total Cash Inflow in the year

- So the first step is to calculate the cash outflow in all the years. This cash outflow also includes the cost of paying the interest (which we would not know in the first pass).

- As a next step, we find the amount available to us through the equity and grants.

- We know that cash inflow has to be equal to cash outflow for all years.

- Whatever is the shortfall, we raise debt to fund it.

- Calculate the cumulative debt

- We calculate the interest on this debt.

- Whatever is the interest on the debt, we plug it back in the project cost (and hence introduce the circular logic in the model)

Step I: Getting the Cash Outflow (Project Costs)

Based on the case, calculate the cash required in each year.

We know the costs of each of the items and what should be the contribution in each year. Multiply the values to get the amounts in each year!

In the same step, we add all the costs (Including the Interest During Construction, though we don’t know it right now)

Step II: Getting the Cash Available (through Equity and Grants)

Based on the equity and grant infusion schedule, we calculate the cash inflows

Step III: Cash Inflow = Cash Outflow

Since the cash outflow has to be matched with cash inflow, we make the total project cost in all years equal to funding in the year

Step IV: Fund the shortfall through debt

Since the only source to fund the shortfall is debt, lets raise the debt as the total fund needs less whatever is available through equity and grants

Step V: Calculate the total debt outstanding

Since there is no way that we can pay the debt in the construction time, we make the outstanding debt as the cumulative debt raised (See me use a trick to accumulate!)

Step VI: Calculate the interest on the debt

Since we have taken money from the bank, we need to pay an interest on it. The interest rate is given to us, let us link the amount to the interest to calculate the interest.

Step VII: The Circular Logic (Plugging back the interest in the project cost)

Since the interest is also a cost of the project (and we are not paying it back to the bank each year), we take it to the project cost.

Out here, if you notice, excel starts a circular calculation and updates all the values! This can be verified by looking at the bottom left of excel and noticing this sign of “calculate”

Beware! Circular References can be dangerous!

What we have achieved in this tutorial is one of the most intricate concepts in project finance -Interest During Construction (IDC). We have also used a fairly advanced function in excel – Circular loops. But please note that circular loops in excel is a dangerous tool. If by chance your excel sheet gets an erroneous value, the error would propagate through the model and there is no way for the model to recover back from the error, unless you know where the circular loop is and you delete and go back from there. For example, if I change 10% interest to “ten”,

I figure that my model is corrupt (It was expecting a numeric input and I gave a string!). But I can go back to 10%, my model does not go back!!

I leave it as a homework for you to figure out, how to go back to a stable state!! 🙂

I will give you a trivial solution (close the sheet and open it again) :). You figure out, where the circular loop is and delete those lines and break it to come back!!

In the meanwhile, happy modeling!!

Project Finance Modeling – Templates to download

I have created a template for you, where the assumption numbers are given and you have to link the complete model!

You can download the same from here. You can go through the case and fill in the yellow boxes. I also recommend that you try to create this structure on your own (so that you get a hang of what information is to be recorded).

Also you can download this filled template and check, if the information you recorded, matches mine or not! 🙂

I am just doing that for the single sheet model and recommend that you do the same for multi-sheet model as a homework problem. If you face any issue, post your excel with the exact problem and we can discuss the way to move forward.

Next Steps

This series gives you a flavor of how project finance modeling is done and an idea about specific nuances in modeling for long gestation projects. I do hope to see you in the financial modeling school.

Join our Financial Modeling & Project Finance Classes

We are glad to inform that our new financial modeling & project finance modeling online class is ready for your consideration.

Please click here to learn more about the program & sign-up.

For any queries regarding the cash impact or financial modeling, feel free to put the comments in the blog or write an email to paramdeep@edupristine.com

49 Responses to “Interactive Pivot Table Calendar & Chart in Excel!”

Excellent post again from awesome chandoo.org

This is one of the post to evident, without using macros we can create excellent charts using available excel options.

Slicer is one of the useful option in excel 2010 .. excited to see more options in excel 2013.

Regards,

Saran

http://www.lostinexcel.blogspot.com

Nice one chandoo............... great work done.....

Cool article. Only downside was that I didn't see at first that I needed 2010. Guess I still have to wait awhile before getting to try this out myself.

I consider myself an Excel expert, but you constantly amaze me with posts like this. Fantastic calendar!

Good post, like this little trick!!

How to not show the value in the cell

format the cell to custom with the below

;;;

Could you add lists of holidays to be transferred to the calendar days?

Two lists would be needed: 1) for the holidays that stay fixed (eg, CHristmas), and 2) for the holidays that move around (eg, Thanksgiving).

Such lists would be prepared externally, and the program would transfer their information to the appropriate days.

Wow! This is something amazing. I am going to do some practicals with this and show a sales trend on this. As we have our sales plans weekly basis, this should impress by boss when put in dashboard. Cool.

And thanks1

Chandoo you have a knack of getting on to these great looking very creative ideas!

One thing with calendars I have seen before is not catering for able to enter notes or appointments or project milestones. But with this one it's easy enough to add the extra lines as you have done for the chart concept and link to this other type of info.

For 2003 we could replace slicers with a validation style dropdown couldn't we?

Chandoo, you are awesome;) i was using calender to show my reports, but i had made all months and then underneith date shows the value, man its really awesome . i am going to use this format for my reports.. only draw back for me is i am using 2007. hence no slicer.. may be have to modify with out slicer.

Why not use =weeknum() for the weeknum column?

Great tricks! I love trying to reproduce the charts myself to get the hang of 'em. This one was great.

My only issue is getting the VBA in the year object to refresh the data. I used the VBA provided at the link, and, I can see it in the Macros tab, but, when I click the spinner the data does not update. Any tips?

Thx!

3G

^^Ignore this! NOT ENOUGH COFFEE YET.

I forgot about the "Assign Macro" option

:-s

Just started at chandoo - this is great!

I opted to use the formula =IF(F6>F5,G5,G5+1) for my weeknum - worked for me (I didn't get all the way through the example, since I'm running Excel 2007 - so don't know if that'll affect anything later in the example). I'm open to comments on this alternative approach.

Thanks for creating this website!

VC (Excel student).

Very cool - but now I'm even more excited for the new time controls for Excel 2013!

Great calendar...

I wonder whether we can make a school calendar (Class, subjects, teachers) using this calendar, assuming the weekly plan is duplicated across the year.

I would love to be a part of creating a class schedule...I'm attempting to help a friend (gratis) to do just that - can you point me in the right direction or provide a sample of sorts?

[...] Wow – what do you think of the interactive calendar chart demo above? To achieve this impressive effect you must have Excel 2010 because it utilises slicers, which is a feature introduced in Excel 2010. Find out how this treasure was created on Chandoo’s page. [...]

Hello Chandoo,

Great works! I learn a lot from this website. Here is the problem I met when I follow your tutorial: once I run and save this cool pivot calendar chart , the size of excel file will increase every time. Could you let me know how to figure it out? Thank you for your time in advance.

An excel chart-fan from China.

I already figured it out.

wow, love the calendar, i'm a newbie, found this site and it's amazing.

Got it mostly figured out, but could do with help with your named range 'tblchosen'

I can build the pivots, link the calendars together but can't see how to use index(tblchosen...) to pull through the productivity figures

appreciate any help

thanks

Great. Miss the Today button. Will try and figure a way to add this to the file.

I want to start the week on Monday, not Sunday (MTWTFSS). Re-arranging the calendar tab works however, any month where the 1st is a Sunday starts on the second and totally omits Sun 1. I have been tinkerign for a while, but can't seem to figure this out.

Changing F2 on the 'Calcs' tab to 2 so that the week starts on Monday works.

Cutting & pasting Sunday on the 'Pivot Calendar' tab and moving all cells up 1 row works.

However, using April 2013 for example, you lose the 1st off of the pivot calendar so that the month starts on 2 April. What should happen is the first row should only show Sun 1 April and then the next row starts Mon 2 April. Still can't fugure out where the problem lies.

"Further Enhancements:

Adjust week start to Monday: Likewise, you can modify your formulas to adjust weekstart to Monday or any other day you fancy."

I have tinkered with this previously with no success, does anyone know which formulas require tinkering, I have only succeeded in breaking this in an effort start a week on a Monday.

[...] Interactivo Artículo original var dd_offset_from_content = 50; var dd_top_offset_from_content = 0; Tags: 2013, calendario, [...]

Completely off topic, but how do you create those animated pictures in your tutorials? It is not a movie (like the Youtube movie), so what software do you use to create such high quality "animated" pictires? Thanks

Jeroen

the animated pics are called Animated Gifs

they are made using Camtasia

Refer: http://chandoo.org/wp/about/what-we-use/

This is fairly easy to do just using calendar formulas, which would be quicker, and doesn't need VBA? Am I missing something?

[...] on how to generate an interactive calendar using pivot tables. Please check out Chandoo’s Interactive Pivot Table Calendar & Chart in Excel before reading this, as I want to go through how I used his method to adapt a calendar which was [...]

Great tip shared by you... howevr would appreciate if you could mention in your tricks about excel version. The example above would work only in excel 2010 and above I believe. Please help me if there is any way we can use the tip in excel 2007 as well..

Many Thanks,

Regards,

FK

Hi, I'm going to give this a shot, but one small question before I do. Can a linked cell be updated based on the date that is selected from the calendar? The calendar is really cool and this would make is especially good to use (and easy and fast).

Regards,

swissfish.

This post is awesome, and using your instructions, I was able to get this to work with a pivot table that pulls directly from a Project Server database. It was a bit complicated to get the day to sum correctly, but I managed to finagle it. I hope you don't mind if I link back to you when I post my instructions.

Thanks for giving me a starting point for this!

[...] http://chandoo.org/wp/2012/09/12/interactive-pivot-calendar/ [...]

This is great, and pretty much everything I was looking for.

However, I already have a large spreadsheet, and I want to include your worksheets in it. I copied all the worksheets and the Module 1, but I can't get it to work. What else do I need to transfer / update please?

Hello there, is it possible to use this pivot to produce a calendar style chart, with returns multiple data per date, which on the calendar then, when clicked links to the data to provide more background information? What do you think? I'd love if I could pivot when i need. thanks, m

Hi, did you ever figure out how to do this? I would love to find a way...

This is amazing and will work well for my calendar project! My question is, how can I expand the calendar to fit a standard sheet of paper?

Wow - this is so creative. I'm taking the basic idea and building a reservation calendar.

Question: How do you get the month and year slicers on a different page than the pivot tables? I'd like to have my final calendar on a separate page from the pivot.

[…] http://chandoo.org/wp/2012/09/12/interactive-pivot-calendar/ […]

This is perfect...is there a way to add notes/tasks to the individual days?

Excel will not let me insert blank rows between lines in the pivot table. I am use Excel 2013 - is there a pivot table tools command that must be used?

I can create the pivot table calender with a year spinner & month slicer but I do not see how to display the the attendance information that I have in the original data table.

Thank you for the wonderful post and I am sorry for my lack of understanding...

Excellent!

Please show me how to add an alternative calendar to this calendar, Chinese or lunar calendar (and by lunar I don't mean phases of the moon), like what they still use in Asia

Thanks

Christopher

[…] Wow – what do you think of the interactive calendar chart demo above? To achieve this impressive effect you must have Excel 2010 because it utilises slicers, which is a feature introduced in Excel 2010. Find out how this treasure was created on Chandoo’s page. […]

Hello my name is Maurice, excuse me for my further request, but believe me, without your help priprio not know how to solve this problem.

So: always using a chart positioned on an excel sheet I wanted to match each square (series) to a single cell, to create a perpetual calendar.

Now everything works fine; except that for a fact, and it is this: In the calendar as you well know some numbers may not be apparent until certain conditions, which I solved by writing this "= O code (AA5 = DATE ( $ H $ 1; MONTH ($ AD $ 12) +1; 1)) and the game and done.

Now I would like to achieve the same thing using the Chart; How can I do to make this happen! let me also just a practical example so that I can understand all the rest then I'll do; Thanks Greetings from A.Maurizio

Link Program : Link: https://app.box.com/s/lhqva3eji0xcf2nmk8lxyki88tt1mi5t

Great info, thanks for sharing

Hi,

I love your calendar however I am modifying it for use in displaying employee performance metrics on a day by day basis.

I see where tblChosen and tblDates are named ranges however I cannot find them anywhere.

Are they assigned to specific cells because I cannot tell.

I see both of them in the Name Manager, which tells me what they refer to but does not give a value or cell location.

@Mike

With the Names in the Name Manager

Simply select the name

Then click in the Refers To: box at the Bottom

Excel will take you to where the Named Range is referring to

[…] Wow – what do you think of the interactive calendar chart demo above? To achieve this impressive effect you must have Excel 2010 because it utilises slicers, which is a feature introduced in Excel 2010. Find out how this treasure was created on Chandoo’s page. […]

Hi, Chandoo

This Pivot Calendar is an excellent idea. I’ve done one for myself using your guidelines. I just need something I’m not being able to do. I need that when I open the file the default date is set to today’s date. I know how to do it with conditional formatting. But I think I’ll need some vba coding for this. Can you please help me with this. Thanks in advance