This is the first installment of Chart Busters.

This is the first installment of Chart Busters.

Chart busters is a new series of posts on PHD and Jon Peltier’s blog. We take turns to exterminate bad charts and associated evils. Although our proton packs are still not perfect, together we are confident of tackling most ghosts trapped in bad charts.

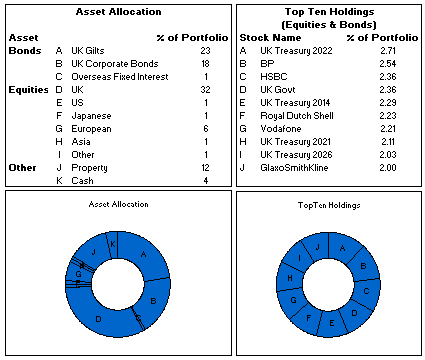

In this installment we take a look at Asset Allocation Chart that looks like it is hexed.

The bad chart

Our reader DMurphy submitted a poorly made asset allocation chart,

If you are looking for an early contender, here’s one which came in to my wife from her Pension company this week showing (or at least attempting to show) the make-up of her investments.

The above image is an excel reconstruction of even sadder looking chart.

What is wrong with it?

- Poor chart selection: Pie charts are good for 3-4 data elements. When we need to present 10 or so items, it is better to use a bar chart or a line chart.

- Not grouping and sorting the information: In the first chart which is displaying Asset Allocation is made from data that has 3 different series – Bonds, Equities and Other. But the chart shows everything in the same way, thus making it difficult to understand how assets are allocated to various classes of investment. Also, the data is not sorted in any meaningful order.

- Poor use of labels: The labels A,B,C … are non descriptive. They are also repeated on the other chart although they mean different things.

The Chart Busters’ Fix

Thanks to guest parachartanalyst Joe Mako, who contributed this fix:

I have taken Joe’s ideas and slightly modified them to create the below chart

Click here to download the above fix in excel and see it yourself.

Added Later: Readers Submitted Fixes

Submitted by Paulo Cesar Semblano da Costa:

- I think Paulo’s version manages to reduce chart clutter a bit more. Very good effort.

- You can download this version from here.

Submitted by Jeff Wier

- Jeff’s version is very good. Again, like Paulo, he managed to reduce the chart clutter bit more and made it look very slick.

- You can download this version from here.

What we have learned?

- Zombies are scary, even when they are looking like donuts.

- Always try to sort the data in some meaningful order before pushing it to charts

- Use a variation of panel chart or color the series sensibly to bring out key differences

- Try to avoid generic labels like 1,2,3 or A,B,C and instead use the actual values and category names

How would you have tackled this?

We dont know how open source the ghost busters were. But Chart Busters are 100% open source. Share your ideas and suggestions for improving this scary little chart to something that makes sense.

When ya gonna call…?

Consult chartbusters today. Send us your bad charts. All you have to do is fill out this google form.

Arent ya gonna read these… ?

What to do no when no one likes your pie | Non sucky excel chart templates

49 Responses to “Interactive Pivot Table Calendar & Chart in Excel!”

Excellent post again from awesome chandoo.org

This is one of the post to evident, without using macros we can create excellent charts using available excel options.

Slicer is one of the useful option in excel 2010 .. excited to see more options in excel 2013.

Regards,

Saran

http://www.lostinexcel.blogspot.com

Nice one chandoo............... great work done.....

Cool article. Only downside was that I didn't see at first that I needed 2010. Guess I still have to wait awhile before getting to try this out myself.

I consider myself an Excel expert, but you constantly amaze me with posts like this. Fantastic calendar!

Good post, like this little trick!!

How to not show the value in the cell

format the cell to custom with the below

;;;

Could you add lists of holidays to be transferred to the calendar days?

Two lists would be needed: 1) for the holidays that stay fixed (eg, CHristmas), and 2) for the holidays that move around (eg, Thanksgiving).

Such lists would be prepared externally, and the program would transfer their information to the appropriate days.

Wow! This is something amazing. I am going to do some practicals with this and show a sales trend on this. As we have our sales plans weekly basis, this should impress by boss when put in dashboard. Cool.

And thanks1

Chandoo you have a knack of getting on to these great looking very creative ideas!

One thing with calendars I have seen before is not catering for able to enter notes or appointments or project milestones. But with this one it's easy enough to add the extra lines as you have done for the chart concept and link to this other type of info.

For 2003 we could replace slicers with a validation style dropdown couldn't we?

Chandoo, you are awesome;) i was using calender to show my reports, but i had made all months and then underneith date shows the value, man its really awesome . i am going to use this format for my reports.. only draw back for me is i am using 2007. hence no slicer.. may be have to modify with out slicer.

Why not use =weeknum() for the weeknum column?

Great tricks! I love trying to reproduce the charts myself to get the hang of 'em. This one was great.

My only issue is getting the VBA in the year object to refresh the data. I used the VBA provided at the link, and, I can see it in the Macros tab, but, when I click the spinner the data does not update. Any tips?

Thx!

3G

^^Ignore this! NOT ENOUGH COFFEE YET.

I forgot about the "Assign Macro" option

:-s

Just started at chandoo - this is great!

I opted to use the formula =IF(F6>F5,G5,G5+1) for my weeknum - worked for me (I didn't get all the way through the example, since I'm running Excel 2007 - so don't know if that'll affect anything later in the example). I'm open to comments on this alternative approach.

Thanks for creating this website!

VC (Excel student).

Very cool - but now I'm even more excited for the new time controls for Excel 2013!

Great calendar...

I wonder whether we can make a school calendar (Class, subjects, teachers) using this calendar, assuming the weekly plan is duplicated across the year.

I would love to be a part of creating a class schedule...I'm attempting to help a friend (gratis) to do just that - can you point me in the right direction or provide a sample of sorts?

[...] Wow – what do you think of the interactive calendar chart demo above? To achieve this impressive effect you must have Excel 2010 because it utilises slicers, which is a feature introduced in Excel 2010. Find out how this treasure was created on Chandoo’s page. [...]

Hello Chandoo,

Great works! I learn a lot from this website. Here is the problem I met when I follow your tutorial: once I run and save this cool pivot calendar chart , the size of excel file will increase every time. Could you let me know how to figure it out? Thank you for your time in advance.

An excel chart-fan from China.

I already figured it out.

wow, love the calendar, i'm a newbie, found this site and it's amazing.

Got it mostly figured out, but could do with help with your named range 'tblchosen'

I can build the pivots, link the calendars together but can't see how to use index(tblchosen...) to pull through the productivity figures

appreciate any help

thanks

Great. Miss the Today button. Will try and figure a way to add this to the file.

I want to start the week on Monday, not Sunday (MTWTFSS). Re-arranging the calendar tab works however, any month where the 1st is a Sunday starts on the second and totally omits Sun 1. I have been tinkerign for a while, but can't seem to figure this out.

Changing F2 on the 'Calcs' tab to 2 so that the week starts on Monday works.

Cutting & pasting Sunday on the 'Pivot Calendar' tab and moving all cells up 1 row works.

However, using April 2013 for example, you lose the 1st off of the pivot calendar so that the month starts on 2 April. What should happen is the first row should only show Sun 1 April and then the next row starts Mon 2 April. Still can't fugure out where the problem lies.

"Further Enhancements:

Adjust week start to Monday: Likewise, you can modify your formulas to adjust weekstart to Monday or any other day you fancy."

I have tinkered with this previously with no success, does anyone know which formulas require tinkering, I have only succeeded in breaking this in an effort start a week on a Monday.

[...] Interactivo Artículo original var dd_offset_from_content = 50; var dd_top_offset_from_content = 0; Tags: 2013, calendario, [...]

Completely off topic, but how do you create those animated pictures in your tutorials? It is not a movie (like the Youtube movie), so what software do you use to create such high quality "animated" pictires? Thanks

Jeroen

the animated pics are called Animated Gifs

they are made using Camtasia

Refer: http://chandoo.org/wp/about/what-we-use/

This is fairly easy to do just using calendar formulas, which would be quicker, and doesn't need VBA? Am I missing something?

[...] on how to generate an interactive calendar using pivot tables. Please check out Chandoo’s Interactive Pivot Table Calendar & Chart in Excel before reading this, as I want to go through how I used his method to adapt a calendar which was [...]

Great tip shared by you... howevr would appreciate if you could mention in your tricks about excel version. The example above would work only in excel 2010 and above I believe. Please help me if there is any way we can use the tip in excel 2007 as well..

Many Thanks,

Regards,

FK

Hi, I'm going to give this a shot, but one small question before I do. Can a linked cell be updated based on the date that is selected from the calendar? The calendar is really cool and this would make is especially good to use (and easy and fast).

Regards,

swissfish.

This post is awesome, and using your instructions, I was able to get this to work with a pivot table that pulls directly from a Project Server database. It was a bit complicated to get the day to sum correctly, but I managed to finagle it. I hope you don't mind if I link back to you when I post my instructions.

Thanks for giving me a starting point for this!

[...] http://chandoo.org/wp/2012/09/12/interactive-pivot-calendar/ [...]

This is great, and pretty much everything I was looking for.

However, I already have a large spreadsheet, and I want to include your worksheets in it. I copied all the worksheets and the Module 1, but I can't get it to work. What else do I need to transfer / update please?

Hello there, is it possible to use this pivot to produce a calendar style chart, with returns multiple data per date, which on the calendar then, when clicked links to the data to provide more background information? What do you think? I'd love if I could pivot when i need. thanks, m

Hi, did you ever figure out how to do this? I would love to find a way...

This is amazing and will work well for my calendar project! My question is, how can I expand the calendar to fit a standard sheet of paper?

Wow - this is so creative. I'm taking the basic idea and building a reservation calendar.

Question: How do you get the month and year slicers on a different page than the pivot tables? I'd like to have my final calendar on a separate page from the pivot.

[…] http://chandoo.org/wp/2012/09/12/interactive-pivot-calendar/ […]

This is perfect...is there a way to add notes/tasks to the individual days?

Excel will not let me insert blank rows between lines in the pivot table. I am use Excel 2013 - is there a pivot table tools command that must be used?

I can create the pivot table calender with a year spinner & month slicer but I do not see how to display the the attendance information that I have in the original data table.

Thank you for the wonderful post and I am sorry for my lack of understanding...

Excellent!

Please show me how to add an alternative calendar to this calendar, Chinese or lunar calendar (and by lunar I don't mean phases of the moon), like what they still use in Asia

Thanks

Christopher

[…] Wow – what do you think of the interactive calendar chart demo above? To achieve this impressive effect you must have Excel 2010 because it utilises slicers, which is a feature introduced in Excel 2010. Find out how this treasure was created on Chandoo’s page. […]

Hello my name is Maurice, excuse me for my further request, but believe me, without your help priprio not know how to solve this problem.

So: always using a chart positioned on an excel sheet I wanted to match each square (series) to a single cell, to create a perpetual calendar.

Now everything works fine; except that for a fact, and it is this: In the calendar as you well know some numbers may not be apparent until certain conditions, which I solved by writing this "= O code (AA5 = DATE ( $ H $ 1; MONTH ($ AD $ 12) +1; 1)) and the game and done.

Now I would like to achieve the same thing using the Chart; How can I do to make this happen! let me also just a practical example so that I can understand all the rest then I'll do; Thanks Greetings from A.Maurizio

Link Program : Link: https://app.box.com/s/lhqva3eji0xcf2nmk8lxyki88tt1mi5t

Great info, thanks for sharing

Hi,

I love your calendar however I am modifying it for use in displaying employee performance metrics on a day by day basis.

I see where tblChosen and tblDates are named ranges however I cannot find them anywhere.

Are they assigned to specific cells because I cannot tell.

I see both of them in the Name Manager, which tells me what they refer to but does not give a value or cell location.

@Mike

With the Names in the Name Manager

Simply select the name

Then click in the Refers To: box at the Bottom

Excel will take you to where the Named Range is referring to

[…] Wow – what do you think of the interactive calendar chart demo above? To achieve this impressive effect you must have Excel 2010 because it utilises slicers, which is a feature introduced in Excel 2010. Find out how this treasure was created on Chandoo’s page. […]

Hi, Chandoo

This Pivot Calendar is an excellent idea. I’ve done one for myself using your guidelines. I just need something I’m not being able to do. I need that when I open the file the default date is set to today’s date. I know how to do it with conditional formatting. But I think I’ll need some vba coding for this. Can you please help me with this. Thanks in advance