I recently went to Sydney to conduct some training programs on Advanced Excel and Power BI. While I was there, I met my good friend Danielle, who runs Plum Solutions, a financial modeling consultancy & training company. We got talking about various things and the topic eventually turned to “finance people and Power BI”. We debated whether finance professionals (analysts, reporting people, financial modelers and controllers) should bother learning Power BI or stick to Excel.

As this is an interesting topic, I am sharing my thoughts in this post along with a video of our debate at the end of it. Feel free to chip in and share your views to.

Let’s examine both sides of the argument. We start with why you need to learn Power BI and then look at why you don’t want to.

Why finance people should learn Power BI?

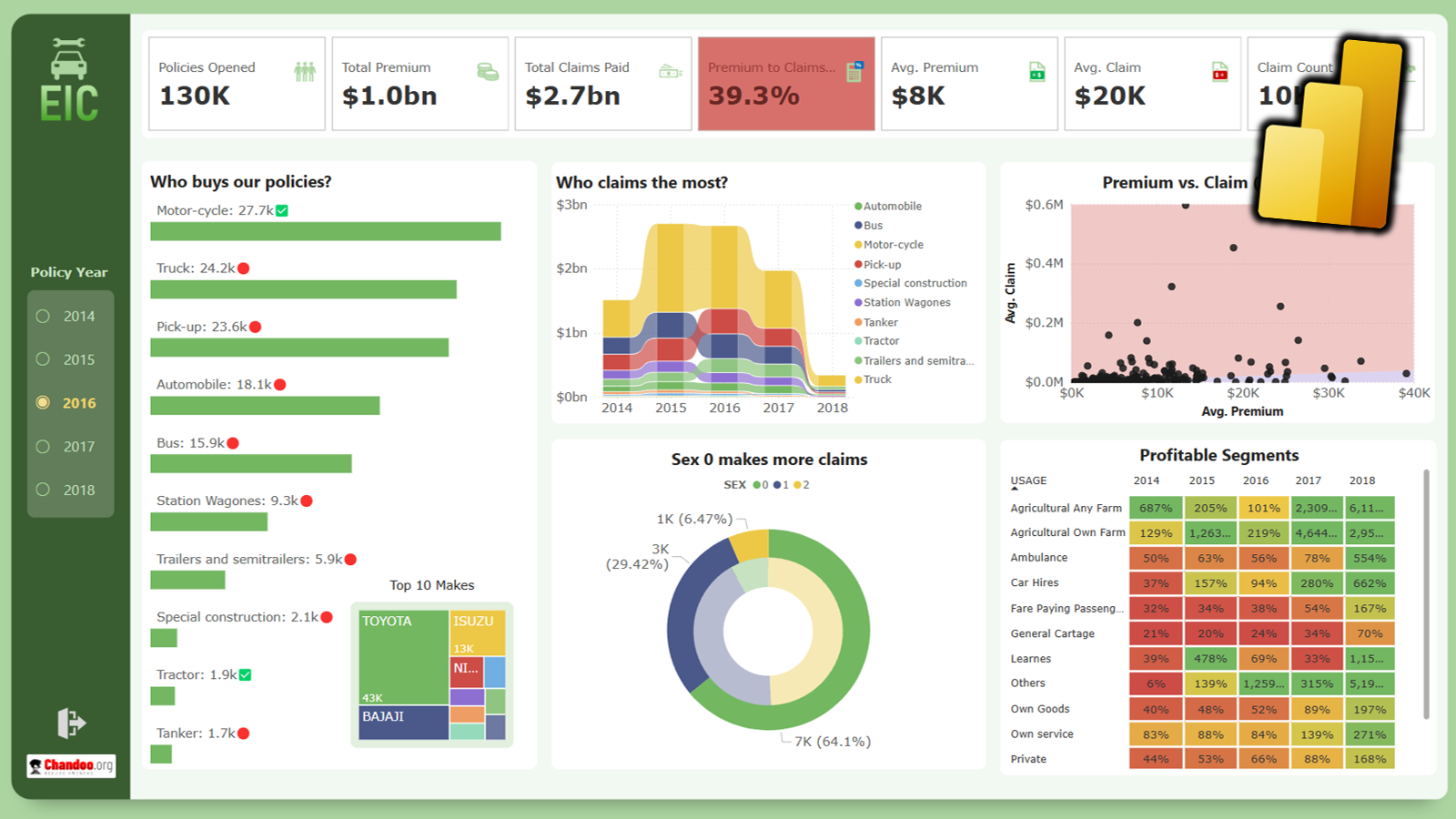

- Power BI is visual & easy: You can quickly take a P&L or complex model outputs and turn them in to a bunch of interactive visuals with Power BI. We all know how much decision makers and customers love visuals. So this is a huge win.

- Power BI makes it easy to share stuff: We all know about the 70Mb workbooks that calculate NPV of a project or compare few different scenarios. Unfortunately that hunk of a file can’t be emailed CFO as she is globe-trotting and can’t run array formulas on her iPhone. On the other-hand Power BI files can be shared easily. You just publish and send the link or notification to the people. They can check it out on phone / tablet / computer and interact too.

- Consolidate data with Power Query: Ok, this is not just Power BI thing. With Power Query, we can consolidate files, stitch together tables and merge different sets of data. This means, no more manual tasks or laborious lookups.

- Visual scenarios with what-if parameters: You can use what-if parameters, slicers in Power BI to make interactive scenarios. This is so much better than using either scenario manager or changing cell values in Excel.

- Work on larger sets of data easily: Excel has physical limit of 1mn rows per spreadsheet. So if you are forecasting operations of a large company, chances are you have more than a million rows and hit the limit in Excel. Power BI has no such limits, so you can happily work on larger data-sets.

- Power BI is regularly improving: Almost every month Microsoft releases a new version of Power BI. This is good for people who are building things as you have new capabilities to rely on and improve user experiences.

Why finance people don’t need to learn Power BI?

- Power BI is not Excel: This is the big one. You can’t create everything you do in Excel with Power BI. Many things that finance people do in Excel like making statutory statements (balance sheets, P&L etc.) or creating scenarios or running monte-carlo simulations on forecasts are ridiculously hard to reproduce in Power BI. Power BI good for visuals, but all the heavy lifting must be done in Excel.

- Power BI doesn’t yet have many basic finance functions: Simple things like calculating NPV or Future value of a cash flow become a laborious mathematical exercise in Power BI. This is because the calculation engine of Power BI – Power Pivot, yet doesn’t have many finance functions.

- Power BI is very technical: Most finance people would learn how to work on finance & accounts in Excel. So Excel becomes a second language for them. But Power BI is not an extension of Excel. It is a deeply technical and complex software. So to get most of out it, finance people need to pick up technical skills like DAX, M and data modeling.

- Power BI is regularly changing: Let’s admit it. Nobody like change. As Power BI rolls out new version every month, you will be forced to stay on top to feel at home. New features come, screens change, buttons move around and options add every month. Knowing all this and keeping up can be hard.

My take – Learn Power BI anyway

I think Power BI is a valuable skill to acquire nevertheless. The reasons:

- Reuse the skills in Excel: Core components of Power BI – Power Query & Power Pivot can be used in Excel too.

- Learning new things is fun: Just as squats make your legs fit, learning new things keeps your brain fit.

- Power BI can open new doors for you: With each new skill you acquire, you will find new opportunities. It can help you find that exciting job or start a business.

- Power BI is free: Power BI Desktop software is free to download and install. There is heaps of free tutorials, examples and videos online (including on chandoo.org) to help you learn it. Even Excel is not free. So why not give it a try.

- Data skills are hot: Skills like how databases work, how to analyze data and how to tell stories thru visuals are very hot now. Power BI (and Excel too) makes it very easy to practice these skills.

Watch the debate with Danielle

I recorded a video with Danielle where we debated pros & cons of Power BI for finance people. Watch it below or see it on my YouTube channel.

What is your take on this?

Do you work in finance? What are your thoughts about Power BI? Share them below using comments. I want to hear what you think.

Want to learn Power BI? See these tutorials & articles

If the jargon of Power BI world is spinning your head, start with this simple explanation of what is Power BI.

For more examples and tutorials, check out the Power BI category on Chandoo.org or see this epic introduction video.

6 Responses to “Should finance people learn Power BI?”

I think you need to learn both. Think of it this way, one is a shovel, one is a rake. Two different tools but both critical to make the garden work. An added benefit is that Power BI will allow you to take your Excel financial reports (or a part of them) and add them to a dashboard. So you get the best of both worlds for your overall reporting. Each tool doing its specific task really well.

I'd recommend anyone dealing with numbers to learn PowerBI. Though in practice will depend on roll.

If your role involves financial modeling, reporting, audit, then it's of benefit.

With more and more executives using mobile device to access reports, it's beneficial to publish reports in web service, rather than in Excel file.

Though I'd recommend starting from learning data structure and modeling, then data transformation, before learning DAX. DAX is highly contextual and can become unnecessarily complex without proper underlying structure.

As for Monte-Carlo simulation, or other type of statistical analysis. PowerBI integrates both Python and R for that purpose.

1) Learn Power Pivot, Power Query, DAX, M regardless of the other issues.

2) If your organization doesn't support PowerBI, don't bother learning it until they do. Graphics sitting on your desktop don't help if you can't easily publish. Maps and charts are nice if you need to send images but it's a nice-to-have if you can fit the learning into the rest of your work, not a must-have.

3) If your expected graphics and dashboards are stable, learn PowerBI. If you're still figuring out what numbers are important, or people are just asking for one or two numbers, stick to Excel for now.

As a CA in data, from my personal experience coupling SQL with Power BI is way more powerful and eases up the need for ad hoc less powerful and complex DAX statements.

Power Query is excellent, but a data problem can easily become too much to handle and with SQL data limits are also not a concern.

^ this statement is so true! As a CPA as well, I try to do most of my transformations as SQL queries within the database then use Power Query to pull those in. M is slow in comparison to SQL while DAX gets unnecessarily complex quickly.

Do you have a SIP Investment tracker template for India