Dear readers & supporters of Chandoo.org,

I am very glad to announce that our brand new online course – “Finance for non-finance people” is now available for your consideration. Please take a few minutes to read this short message to understand what this program is & how it benefits you. If you are ready to join, please click here.

What is Finance for Non-finance people course?

This course aims to teach financial fundamentals & introduce you to the world financial analysis in a no-nonsense way.

This course aims to teach financial fundamentals & introduce you to the world financial analysis in a no-nonsense way.

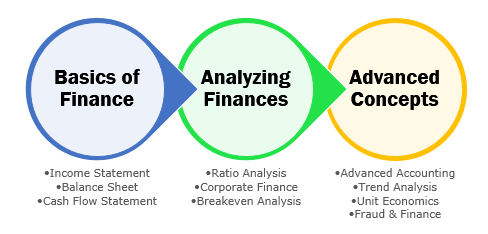

We start by introducing financial analysis and the basic jargon. Then we talk about 3 important components of any company’s finances – Balance Sheet, Income Statement & Cash flow Statement.

Then we discuss about various analytical techniques like ratio analysis, valuation mechanisms, break-even analysis.

Finally we explain advanced accounting concepts like long-lived assets, depreciation, explore trend analysis and unit economics.

In a nut-shell, this course takes someone with no finance background and makes them proficient in world of finance.

Who should opt for this course?

As the name suggests, this course is for non-finance people who need to learn the language of finance.

We have hand-crafted this course especially for,

- New entrants to corporate finance & analyst positions

- People with non-finance background

- Anyone aspiring to manage or own a business

- Professionals in domains like Marketing, IT, HR, Production etc. and looking for senior management roles.

These days, almost any top management position (GM, VP, EVP, CXO levels) require fair amount of cross domain knowledge to make better business decisions. While one can learn marketing, operations, HR or strategy with a fair amount of practice, world of finance continues to be difficult for outsiders. That is where this course comes. It gives you a solid & necessary background to finance domain so that you can reach the next level.

What topics are covered in this?

We have 12 modules in this program, divided in to 3 areas.

Area 1 – Basics of Finance

The focus of Area 1 is to teach you the language of finance.

Module 1 – Need for Financial Analysis

An overview of benefits of financial analysis & situations where it is used. [1 video, 17 minutes]

Module 2,3 & 4 – Understanding Financial Statements

A deep dive in to 3 important financial statements you will find in any business – Income statement, Balance Sheet & Statement of Cash flows. What is the purpose of each and how to structure, understand & analyze them. We use a case study to help you get holistic perspective of these statements. Also, you will learn how to use various Excel techniques to model the same. [15 videos, 3.5 hours]

Module 5 – Complete Business Perspective

Now that you know the basics, time to gain complete perspective of a business by tying together income statement, balance sheet & cashflow & interpreting the messages. [1 video, 27 minutes]

Area 2 – Financial Analysis & Interpretation

The focus of area 2 is to let you explore the numbers in various financial statements & understand how well the company is doing.

Module 6 – Ratio Analysis

Thorough overview of various ratios like – profitability, liquidity, activity, solvency, market ratios and understanding DuPont Analysis. [8 videos, 1.5 hours]

Module 7 – Introduction to Corporate Finance

Understanding how companies view money & make decisions by learning important concepts like time value of money, NPV, IRR, Free cashflows, Dividend discount model, Analysis of multiples. This is the most detailed and crucial part of our course. [13 videos, 3.5 hours]

Module 8 – Breakeven Analysis

Analyzing breakeven & profitability of a company with help of a case study. Also learn variations of break-even due to taxes, synergies and how to present break-even analysis in a dashboard [6 hours, 1.5 hours]

Area 3 – Advanced Concepts

In this area, the focus is on advanced accounting & analysis concepts.

Module 9 – Advanced Accounting Concepts

Learn about concepts like long lived assets, depreciation, amortization, working capital management. [9 videos, 2 hours]

Module 10 – Trend Analysis

Introduction to basic statistical measures, trend analysis, coefficient of variance etc. [4 videos, 30 minutes]

Module 11 – Unit Economics

Understand how to calculate various metrics (cost, profits, revenues etc.) on per unit basis and see how improving them can impact a company’s business. [4 videos, 45 minutes]

Module 12 – Fraud & Finance

After all, the world of finance is just interpretation of numbers. So there is always scope for fraud. Learn how to detect fraud and how to implement checks and balances. Explained with cases of infamous Xerox, Worldcom & Enron. [4 videos, 45 minutes]

A video demonstration of this course & more

For a video demonstration of the course & more details, visit Finance for non-finance course page.

Benefits for you

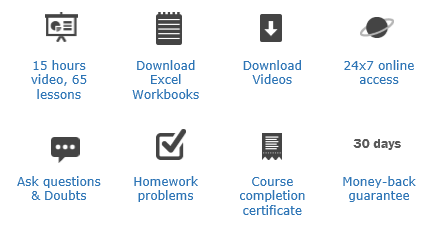

When you enroll in this program, you will get the following benefits.

- 65 video lessons with 15 hours material: Access in-depth content on all aspects of financial analysis right from basics to advanced accounting concepts.

- Notes, Excel Files & Documents: Download study & lecture notes, completed & blank Excel workbooks, documents & presentations used in the course and learn better.

- Online Access to our classroom: Access our secure online classroom and learn at any time from anywhere.

- Download videos: HD quality videos of all lessons can be downloaded for future reference and storage.

- Ask questions & doubts: You can ask course related questions, doubts & share your experiences with our faculty any time & get guidance.

- Participation Certificate: Get participation certificate and show off your knowledge.

- 30 day money back guarantee: No questions asked, if you do not enjoy our course, just ask and get your money back.

Join Finance for Non-finance Program

Frequently Asked Questions…

1. Should I know a lot of Excel to join this class?

A. No, Just basic Excel knowledge is enough. In this course, we teach all the Excel features you need to know to understand & analyze finances.

2. What payment methods are accepted?

A. You can pay by any credit card or use your PayPal account. If you are in India, you can pay by Debit cards, net banking & credit cards as well.

3. Any discounts for multiple enrollments?

A. We offer 25% discount for multiple (team) enrollments (3 or more). Just enter the quantity during check out to get the discount automatically.

Any more questions or doubts?

Please get in touch with me at chandoo.d@gmail.com or call me on +91 814 262 1090. You can also contact Paramdeep, our course instructor at paramdeep@edupristine.com to know more about this course and how it can benefit you.

We hope to see you in our Finance for non-finance program.

Thank you…

Once again thank you so much for your thirst to learn more & be awesome. I hope you will use this program to plunge in to finance world and learn something new & exciting. Click here to join us.

3 Responses to “Introducing ‘Finance for Non-finance people’ training program”

Hello

Have a look at FREE "Introduction to Finance" course on Coursera by Prof Gautam Kaul of University of Michigan.

Good Luck

Sini

Good resource Sini. A free course or university class is also another way to learn. As long as you are learning something and becoming awesome, we are happy. Please look at below pages as well for excellent training on basic & advanced finance -

http://chandoo.org/wp/2012/11/21/introduction-to-financial-ratios/

http://chandoo.org/wp/2012/12/11/dressing-financial-statements-using-excel/

and http://chandoo.org/wp/tag/financial-modeling/

Thanks for sharing this. This definitely help me to understand finance well. This is a very useful article. I'll definitely return to this site since I want to enter finance world.