In early February Sujit asked a question at Chandoo.org, original post.

I require a formula stating criteria [0%-25% output will be 0, 26%-50% output will be 0.1, 51%-75% output will be 0.2, 76%-100% output will be 0.3 & 100% + output will be 0.4]

Kyle, responded with a neat Sumproduct formula

=SUMPRODUCT((B3>{0.25,0.5,0.75,1})*0.1)

I think it is so neat that it is worthy of sharing and detailing here at Formula Forensics:

So today we will pull Kyle’s answer apart to see what’s inside.

Kyle’s Formula

As usual we will work through this formula using a sample file for you to follow along. Download Here.

Kyle’s formula is a Sumproduct based formula

=SUMPRODUCT((B3>{0.25,0.5,0.75,1})*0.1)

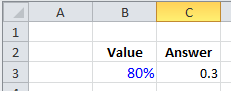

Lets look at cell C3 as our example.

;

;

In C3 we see the formula: =SUMPRODUCT((B3>{0.25,0.5,0.75,1})*0.1)

Which consists of a Sumproduct function and a formula inside the sumproduct.

We know from Formula Forensics 007 that Sumproduct, Sums the Product of the Arrays, and that when there is only 1 array it simply sums the array elements.

In this case the Sumproduct only has a single array as an element

=SUMPRODUCT((B3>{0.25,0.5,0.75,1})*0.1)

and so the (B3>{0.25,0.5,0.75,1})*0.1 component must return an Array of elements for the Sumproduct to sum.

If we now look at the (B3>{0.25,0.5,0.75,1})*0.1 component.

We can see that it consists of a comparison B3>{0.25,0.5,0.75,1}

The result of the comparison is Multiplied by 0.1.

Sujit’s orginal question asked: 0%-25% output will be 0, 26%-50% output will be 0.1, 51%-75% output will be 0.2, 76%-100% output will be 0.3 & 100% + output will be 0.4

And Kyles formula is using B3>{0.25,0.5,0.75,1} to work out which category the value in B3 belongs to.

We can see this if in a blank cell say C5: we enter the following:

= B3>{0.25,0.5,0.75,1} press F9 not Enter.

Excel will respond with ={TRUE,TRUE,TRUE,FALSE}

This is showing us that the 1st, 2nd and 3rd elements in the formula: B3>{0.25,0.5,0.75,1}, are True

In our example the value in B3 is 80% which is 0.8 which is Greater than 0.25 and Greater than 0.5 and Greater than 0.75, but Not Greater than 1.0.

The next part of Kyle’s formula is (B3>{0.25,0.5,0.75,1})*0.1

In a blank cell say C7: enter the following:

= B3>{0.25,0.5,0.75,1}*0.1 press F9 not Enter.

Excel will respond with ={0.1,0.1,0.1,0}

This is showing us the result of

=(B3>{0.25,0.5,0.75,1})*0.1

={TRUE,TRUE,TRUE,FALSE} *0.1

={0.1,0.1,0.1,0}

Sumproduct now only has to add up the Array

=Sumproduct({0.1,0.1,0.1,0})

Which it does returning 0.3.

The Neat Part

The neat part of this is that Kyle has used the 0.1 Multiplier to Force the array to an array of Numbers for Sumproduct to sum.

Had Kyle used: =SUMPRODUCT((B3>{0.25,0.5,0.75,1}))*0.1

Excel would have returned an answer of 0

This is because as we saw in Formula Forensics 007, Sumproduct doesn’t know what to do with the array of True/False, they need to be converted to numerical equivalents for Sumproduct to operate on.

In a spare cell, say C9, enter: =SUMPRODUCT((B9>{0.25,0.5,0.75,1}))*0.1

Excel will respond with 0

Of course that can be fixed by using a double degative of a 1* inside the formula

In a spare cell, say C10, enter either:

=SUMPRODUCT(1*(B9>{0.25,0.5,0.75,1}))*0.1

or

=SUMPRODUCT(- -(B9>{0.25,0.5,0.75,1}))*0.1

Excel will respond with 0.3 as it should

Except that the formula is longer and now has to do 1 more multiplication.

Download

You can download a copy of the above file and follow along, Download Here.

Formula Forensics “The Series”

You can learn more about how to pull Excel Formulas apart in the following posts

We Need Your Help

I have received a few more ideas since last week and these will feature in coming weeks.

I do need more ideas though and so I need your help.

If you have a neat formula that you would like to share and explain, try putting pen to paper and draft up a Post like above or;

If you have a formula that you would like explained but don’t want to write a post also send it to Chandoo or Hui.

32 Responses to “More than 3 Conditional Formats in Excel”

Dude,

Long time... whts up , I see that urs is the only business which is posting a "Excel" lent growth in this recessionary market....

Still alive ... so you will be able to reach me if make an attempt... 🙂

V E R Y N I C E !!!!

Hi Chandoo.

When I use your macro in my file, I keep getting a Compile Error because the "cell" variable is not defined.

Any suggestions?

@Lincoln: Did you have "option explicit" on?

I am sorry, I didn't define the cell variable.

you can add this line to the code just below the line "dim i"

dim cellLet me know if you still get this error...

Ah. I've simply declared cell as a range.

All good now

Noob at work.

Thanks for the article. Very helpful. 🙂

very, very helpful. I didn't know what "define named ranges" meant. one of my colleagues figured it out. I suggest you add the instruction "go to menu - insert/name/define and then make sure the cells at the bottom of the box change to reflect new values if you redefine the range." thanks.

Quite Intresting. If anyone could help. I am trying to do something like this but i want to define values and colours of the value in a range of cells ( Similiar) but i want the other cells to change colour when the value is same as the range defined. ANy help. I want instantaneous( Like conditional formatting) not like running macro.

@Jahabar: Welcome to PHD and thanks for the comments.

If your source range and target range have same dimensions and source range has 4 different formats (conditional formatting limitation, unless you are using excel 2007) you can do this. If you have more than 4 formats then you may have to use VBA (and create an event like worksheet_change and monitor the range).

Let me know if you come across a simple non-vba solution for this. 🙂

very nice post...

May I suggest a little modification of the code?

Adding "Application.ScreenUpdating = False" at the beggining of the macro and "Application.ScreenUpdating = True" at the end speeds up significantly the whole procedure. As well as omitting "Operation:=xlNone, SkipBlanks:=False, Transpose:=False".

Not a big deal in this example, but when formatting a larger range of cells, the difference is marked. I've tried to format the number 1457 of cells and the formatting was done 11 seconds faster. :-O

[...] you can overcome the conditional formatting limitation using VBA macros (again, if you are new to excel, you may want to wait few weeks before plunging in to [...]

Hi Chandoo

Thanks for this macro. I have done few changes to this macro to suit my needs. I had removed the defined names data2use and conditions2use to ActiveWindow.RangeSelection.Address

This way I can select the cells that require conditional formatting and then run the macro.

Kind Regards,

Vasanth

Chandoo, I am using 2007. I noticed the conditional formatting options are different - and they have some built in funtictions for stop light displays, and other dashboard type elements. My question is this, I need to display more colors in the stop light than the standard 3. The World Health Org (WHO) has a Pandemic Flu alert level between 0-6, so i wanted to drive a sharepoint dashboard using excel based on 7 distinct levels. Suggestions?

@ASM: very good idea. you can use font based symbols instead of excel traffic light icons to achieve this. the character "=" becomes a small circle when you change the font to "webdings". So you just need to insert a bunch of = signs and use conditional formatting to change the font color. If you need to combine numbers with symbols, then you can use 2 columns instead of one and format them accordingly. Let me know if you need some more help with this.

Also, if possible, share with us your dashboard when it is ready.

[...] Once we calculate values for all team members using the above formula, we can apply conditional formatting to make the heat map. In Excel 2007, this is one step. In earlier versions of excel, you need to specify 3 conditions to make the heatmap look hot enough or use a macro to get over the 3 conditional formats limitation. [...]

Chandoo,

Why do you use the "conditions2use" since you can change the VBA and replace "conditions2use" with "data2use" and you won't have to create a zone for conditional formating equal to the data zone.

The Data will be formated according the "formats2use". Just one thing, if you plan to have some "0" on your data zone, they will be formated like the first cell above your "formats2use" (the green cell with "Formats" inside in your exemple".

That's why you should leave a white empty cell above the first cell of the "formats2use" zone.

Regards,

Pitichat

Seeing as no one has posted what they actually might use something like this for here's my 2cents;

I used the same concepts to build a heatmap of a casino gaming floor, with each populated cell representing a gaming machine (Slot Machine), some simple metric bucketing to determine different shades for the cells, user selectable colours, ability to pick a 'machine' (click on a cell) and repaint the 'floor' showing only machines with similar charateristics, select a value range and repaint the 'floor' showing only the 'machines' within the value range. Users could switch between metrics and repaint the the floor.

It took a while to put together, but once in use was rolled out to four casinos and used for 4 years. It provided a portable (i.e. no custom software), easy to understand way to manage product from individual machine to groups / classes of product and made it very easy to see how products were performing in geographic relation to each other (something that tables & graphs can't easily do)

Needless to say it "wowed" many people who only saw Excel as a tool for managing numbers and table based reports

Being excel just about any user could maintain spreadsheet.

@ Justin B - Hey Justin, that counds AWESOME! Can I get a copy of the casino tracker, I work within a similar industry and would love to see how you've constructed it.

Also, from using this heatmap, I think I'm getting confused. To make the map change color, I thought you had to change the DATA2USE cells, but I see it only changes if you change the vales of thew cells within the CONDITIONS2USE cells. Am I thinking this wrong?????

Thanks all, this is REALLY making my life easier!!

Hi Dude,

Thanks for this very useful macro. That was very helpful.

Kepp up the good work.

Cheers.

Explanation like yours is so important to everyone that want to learn more and more in Excel. Thanks a lot. You are the man ! 🙂

[...] http://chandoo.org/wp/2008/10/14/more-than-3-conditional-formats-in-excel/ [...]

Chandoo,

If I wanted to replace the numbers 1-9 with text A-I, what would I need to do to the macro to make it work correctly?

Thanks!

@Lee

If the numbers are alone and not part of larger numbers >10 or with text you can simply use this formula

=CHAR(A1+64)Change A1 to your cell

Copy Down/Across as required

Then select the new cells and copy/paste as Values over themselves.

I'm trying to do a drop down list that will allow me to select a color and when I select that color it will change my cell to that color. i cannot use contion formating because I have 5 colors. Can you help me with this?

thanks

This tool was great. Can you please suggest a way to include conditions like if value in a cell lies in a range color some other cell red.

What do I need to change in the programing if I have a mix of numbers and letters. Example; 5003, 2B01, W005, 1020. I think the problem is the CInt code but I'm not sure.

EXCELlent - was able to use your macro with no problems. Found that modifying it to use the DATA2USE range achived the same result as using the condition2use range. If the two ranges were equal, your way allows the data range to have completely different values and still have the same color format at the end.

My data is a little different

I have an irregular shaped building with students in it.

I have a list of students assigned to the rooms with the courses they are on

and a color code for the courses

would there be a way of using indirect to translate the student names to color code the rooms to what courses they are on?

[...] hi Check below link More than 3 Conditional Formats in Microsoft Excel - How to? | Chandoo.org - Learn Microsoft Excel O... [...]

The ability to conditional format a range of cells based on criteria in a different, but matching for size, range of cells is exactly what I've been looking for. Unfortunately the macro falls over at the line conditions (i) = CInt (cell.value). I have specified the 3 rangenames, working in excel 2003 but cannot get it to work. Any ideas. I've checked rangenames several times (0-16 being used) but no luck. Thanks

Hello you also can use this code to force ur worksheet to run with more then on condition.

in this case the condition = case like in example if u want to format something between of the range 0 to 100 for a color

Set I = Intersect(Target, Range("B2:B8")) <-- thatch the rage u want to work with just set it up for range of cell u want to use to format

the second formula will show u Interior color nr index just time it and when u format the cell with a color it will show nr in the cell

enjoy

Private Sub Worksheet_Change(ByVal Target As Range)Set I = Intersect(Target, Range("B2:B8"))

If Not I Is Nothing Then

Select Case Target

Case 0 To 100: NewColor = 37 ' light blue

Case 101 To 200: NewColor = 46 ' orange

Case 201 To 300: NewColor = 12 ' dark yellow

Case 301 To 400: NewColor = 10 ' green

Case 401 To 600: NewColor = 3 ' red

Case 601 To 1000: NewColor = 20 ' lighter blue

End Select

Target.Interior.ColorIndex = NewColor

End If

End Sub

Private Sub Worksheet_SelectionChange(ByVal Target As Range)

Range("F1:F1") = Range("F1:F1").Interior.ColorIndex

End Sub

Hi Chandoo,

I tried to add the "More than 3 conditional formats for Excel" VBA macro

to my Excel 2008 for Mac and it didn't work. Would this VBA macro work

with Excel 2011 for Mac? Does it have to be a certain version: Student,

Home & Office, or Standard?

Thanks for your help.

Tom

[…] here is one vba macro that might be better if need lots of cases http://chandoo.org/wp/2008/10/14/more-than-3-conditional-formats-in-excel/ […]