What is Financial Modeling School?

This is an online training program to teach you,

» How to do Financial Modeling using MS Excel

» How to do Project Finance Modeling using Excel

At the end of the program you will be able to develop an integrated financial model or project finance model. We will use a practical case study to understand various steps of modeling & build one by the end of the program.

Why should you join Financial Modeling School?

This program is suitable for people in investment banking, project management, equity research, business planning, strategy, private equity, funds or commercial banking. It is also ideal for people who want a career with any of the above activities.

The program assumes you have basic knowledge of MS Excel. We will teach you various features Excel as part of the course, it is advisable that you know how to use Excel.

What Topics are Covered?

We have 2 modules in the program. (1) Financial Modeling Module (2) Project Finance Module

The course contents for Financial Modeling are,

| Financial Modeling School Topics: | |||

| Designing an efficient layout | Inputting the historical statements | Analyzing the growth drivers | Forming growth assumptions |

| Projecting future P&L and B/S | Creating Asset & Dep. Schedule | Creating Debt schedule | Equity & Retained Earnings |

| Creating Cash Flow statement | Circular loop and Cash updation | Analyzing Ratios | Valuation by DCF |

| Valuation by Comps | Charting a football field | ||

The course contents for Project Finance Module are,

| Project Finance School Topics: | |||

| FSS Nuances for Project finance | Components of Real Estate (RE) Financial Model | RE Investments: Key Metrics | Key Concepts in RE Model – Designing an efficient layout |

| Understanding circular loops in Excel | Interest During Construction | Modeling Depreciation and Deferred Taxes | Deferred Tax and Loss Carried Forward |

| Cash Distribution and Tranches | Modeling Delays | Debt Servicing Reserve Account (DSRA) | Modeling Commercial Complex |

| Modeling Assumptions | Modeling Area parameters | Modeling EPC Cost and Phasing | Modeling financing Schedules |

| Modeling NOI and Expenditure | Building financial statements | Valuation and Analysis | |

The course contents for Excel School are,

| Excel School Topics: | |||

| Formulas | Formatting | Conditional Formatting | Basic Charting |

| Advanced Charting | Excel Tables | Pivot Tables | Data Validation, Filters |

| Advanced. Formulas | Importing External Data | Shortcuts, Productivity | Basic Form Controls, Macros |

How does Financial Modeling School Work?

We have made a short video to tell you how it works. Please watch it below:

Financial Modeling School – Course Brochure

Please download our course brochure: Financial Modeling School Course Details & Methodology [PDF]

What do you get when you Join?

- 20 hours of Financial Modeling Online Training

Each of the 14 topics in this program come with several videos discussing the process of constructing model in excel. There is a total of 20 hours of videos planned. All these lessons are neatly structured in to a lesson plan with links to view, download and discuss. You can follow the lesson plan and boost your modeling skills in a very short period of time. - 20 hours of Project Finance Modeling Online Training

Each of the 12 topics in this program come with several videos discussing project finance modeling in excel. There is a total of 20 hours of videos planned. All these lessons are neatly structured in to a lesson plan with links to view, download and discuss. You can follow the lesson plan and boost your modeling skills in a very short period of time. - 24 hours of Microsoft Excel Training [Optional]

You can sign-up for the optional Excel School and learn various concepts and practical uses of MS Excel. This course takes a practical approach and makes you a master of Excel. You can download all the course material and lesson videos for later reference. For details please refer to Excel School page. - Example workbooks – both Empty & Completed ones

At each step, we will provide you an example workbook so that you can immediately apply the knowledge gained in the class. You can verify your solution against ours using instructor version of same workbook. This will make your modeling skills rock-solid. - 6 month Access to Online Classroom

Online classroom is a blog-like area with secure userid and password for students. This is where you can ask questions related to lesson topics, discuss the lesson content or share your tips / ideas with other students. You can access the classroom for 6 months from data of joining. - Free Bonus – List of Keyboard Shortcuts PDF

This one page PDF includes some really powerful and useful Excel Keyboard Shortcuts. - Free bonus – Chart Design E-book

In this short 24 page e-book, we explain the process you should follow to format your charts to wow your audience. It also includes guidance on colors to use. - 30 Day money back guarantee

Each Financial Modeling School membership comes with a 30 day money back guarantee. If you don’t like what you see, just drop me an email and I will refund your money. No questions asked.

Join Financial Modeling Classes Now

|

||||

|

||||

Alternative Payment Options Credit Card, Local Currency, Indian Rupee etc.

If you wish to join our Financial Modeling Classes without the hassle of going thru PayPal, use below options.

- Payment Details for Bank Transfer / Check – Click here

- Payment by Credit Card, Net Banking & Debit Cards – Coming Soon.

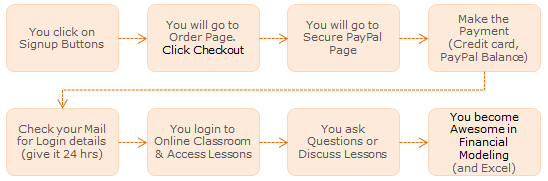

How the Purchase Process Works?

Frequently Asked Questions

I have answered 3 most frequently asked questions here:

- What payment methods are accepted?

You can pay by credit card (VISA, Master, AMEX etc.) or with your PayPal Account. In some countries, you can also pay by electronic check. Use the most convenient option from Checkout page. - What version of Excel is used in these Classes?

We use Excel 2007 to conduct the classes. However, most lessons can be applied to Excel 2003 onwards. - Can I upgrade to other options after joining the course?

You can upgrade to any other option once you join the course. You will find the details inside the Financial Modeling School.

We hope to see you in Financial Modeling School.