Hello Gurus

I am trying calculate state payroll taxes based on 3 states with different tax rates and wage thresholds. As an example for California state unemployment taxes are calculated on the first $7000.00 of employee wages.

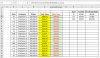

I have attached a sample worksheet with desired output.

Really appreciate your help.

Thanks

I am trying calculate state payroll taxes based on 3 states with different tax rates and wage thresholds. As an example for California state unemployment taxes are calculated on the first $7000.00 of employee wages.

I have attached a sample worksheet with desired output.

Really appreciate your help.

Thanks