jaideep211

New Member

Hi All

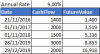

I need a help with finding the correct formula for my excel model. I am trying to calculate cumulative future values of unequal cash flows as explained in the example below:

• In the screenshot above, in column D, I need to calculate the cumulative FV of the cash flows.

• I have cash flows coming in at different dates. These are not random dates but dates that increase in one direction.

• I can invest each of these cash flows at a certain interest rates.

• I need to be able to know what is the total FV of all cash flows at each given date.

• For D24, the answer is C24 + FV of all prior cash flows as at Nov 1, 2018 (B25)

• However, just copying the D24 formula will not help me obtain D25 since for D25, a new variable is added (refer to the formula in column E.

• In this example I have manually written the formulas for each cell in column D. However, I this method becomes impractical if I have nearly >300 rows to calculate.

I have considered creating an table such as this while copying the relevant formulas however, it again makes the excel too big.

Any help is much appreciated.

Thanks..!

I need a help with finding the correct formula for my excel model. I am trying to calculate cumulative future values of unequal cash flows as explained in the example below:

• In the screenshot above, in column D, I need to calculate the cumulative FV of the cash flows.

• I have cash flows coming in at different dates. These are not random dates but dates that increase in one direction.

• I can invest each of these cash flows at a certain interest rates.

• I need to be able to know what is the total FV of all cash flows at each given date.

• For D24, the answer is C24 + FV of all prior cash flows as at Nov 1, 2018 (B25)

• However, just copying the D24 formula will not help me obtain D25 since for D25, a new variable is added (refer to the formula in column E.

• In this example I have manually written the formulas for each cell in column D. However, I this method becomes impractical if I have nearly >300 rows to calculate.

I have considered creating an table such as this while copying the relevant formulas however, it again makes the excel too big.

Any help is much appreciated.

Thanks..!