I have a basic personal cash flow workbook.

Sheet 1 has the bank balance AND the amount I owe to my 2 credit cards.

I pay my CC's in FULL at a fixed monthly due date

The second sheet contains the cash flow for say 3 month ahead.

Any Income I get I record, as well any expense.

Here is the challenge: I use my CC's heavily so If I record each transaction it will ruin by Bank balance ( since they are due 30 days after the date it is recorded)

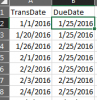

The rule is : Next CC due payment is KNOWN 25th of the coming month; so if i am recording a cc transaction it will be taken either next cc due date OR the one after it ( a month difference).

HOW can I do that.......

Rather than send you my current workbook which is useless with regard to this issue, or I wait for your input AND THEN send you my new workbook for you to review ??

Sheet 1 has the bank balance AND the amount I owe to my 2 credit cards.

I pay my CC's in FULL at a fixed monthly due date

The second sheet contains the cash flow for say 3 month ahead.

Any Income I get I record, as well any expense.

Here is the challenge: I use my CC's heavily so If I record each transaction it will ruin by Bank balance ( since they are due 30 days after the date it is recorded)

The rule is : Next CC due payment is KNOWN 25th of the coming month; so if i am recording a cc transaction it will be taken either next cc due date OR the one after it ( a month difference).

HOW can I do that.......

Rather than send you my current workbook which is useless with regard to this issue, or I wait for your input AND THEN send you my new workbook for you to review ??